With the increasing push for digital transformation in taxation, businesses operating in Saudi Arabia must comply with the Zakat, Tax, and Customs Authority (ZATCA) e-invoicing regulations.

ZATCA e-invoicing integration with Microsoft Dynamics 365 ERP, especially for B2C scenarios, requires aligning your system with Saudi Arabia’s e-invoicing regulations, known as FATOORAH. This is achievable through ZATCA API integration.

This blog will walk you through all the steps required to perform B2B C integration using a third-party API.

Understanding ZATCA e-invoicing compliance

ZATCA has introduced e-invoicing (FATOORAH) regulations in two phases:

- Generation Phase (December 4, 2021): Businesses must issue electronic tax invoices with QR codes, ensuring accuracy and compliance with the basic standards.

- Integration and Reporting (Advanced Stage) (January 1, 2023): During this phase, businesses must interface their systems with ZATCA’s platform to validate invoices and report in real-time.

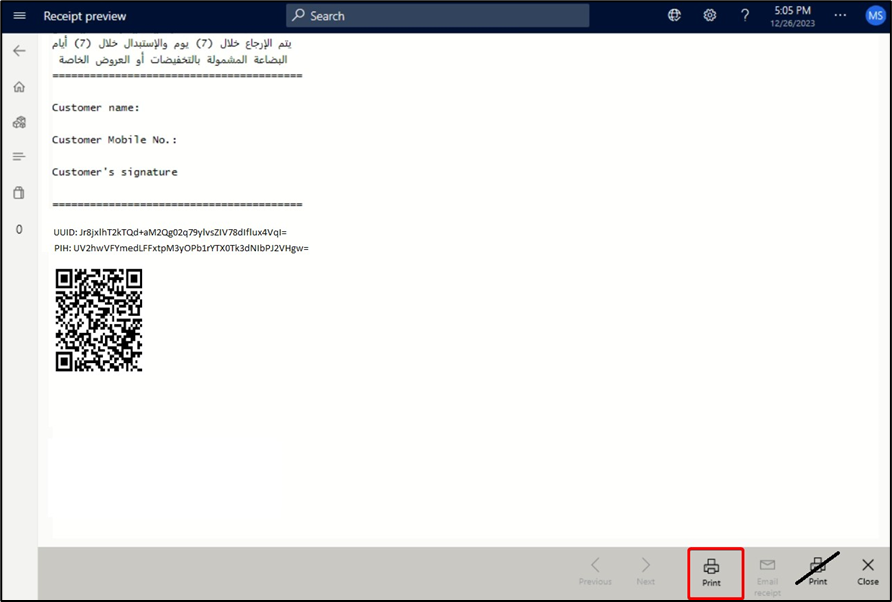

To achieve compliance, organisations must ensure their ERP systems support XML formats, digital signatures, QR codes, and API integration with ZATCA’s platform.

More insights: Understand the ZATCA e-invoicing journey and its compliance stages.

Why is ZATCA compliance mandatory?

ZATCA compliance is mandatory because it’s part of Saudi Arabia’s broader push toward digital transformation, tax transparency, and economic accountability.

- Secure e-invoicing: Ensures invoices are tamper-proof and meet security standards.

- QR code implementation: Adds a QR code to invoices for quick verification and compliance.

- Integration with ZATCA’s portal: Enables real-time submission and validation of invoices via APIs.

- Tamper-proof invoices: Ensures data integrity and prevents unauthorised changes to invoices.

- Global alignment: Many countries are adopting similar e-invoicing mandates. ZATCA’s system helps Saudi Arabia align with international standards and attract foreign investment.

These requirements push businesses to adopt robust digital systems that seamlessly manage compliance.

Read further: Explore the steps to generate ZATCA-compliant e-invoices for both B2B and e-commerce customers.

ZATCA integration with Dynamics 365 using ClearTax

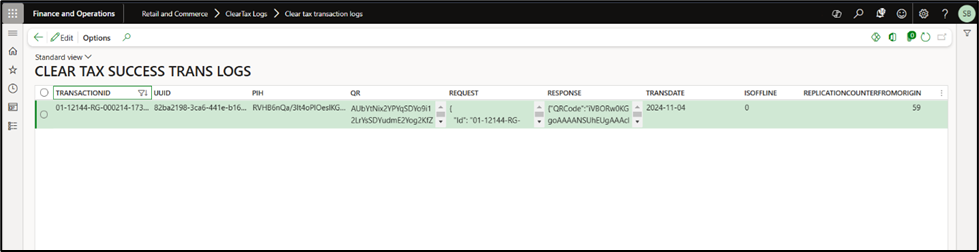

ClearTax functions as a third-party API provider, specifically, a Government-Approved Service Provider (GSP) and Application Service Provider (ASP). That means it acts as an intermediary between your ERP or POS system (like Microsoft Dynamics 365) and the ZATCA platform.

Instead of building a direct integration with ZATCA’s APIs yourself—which can be complex and time-consuming—you can use ClearTax’s APIs to handle:

- Invoice formatting and validation

- Cryptographic stamping and QR code generation

- Real-time or batch submission to ZATCA

- Response handling and error management

So while ClearTax is technically a third-party API, it’s a trusted and certified one that simplifies compliance and reduces the burden on your internal IT team.

Before getting started, let’s walk through the key alignment steps.

Note: This is the approach we follow at Confiz.

1. Requirement analysis & system assessment

At Confiz, we analyze the clients’ specific e-invoicing obligations under ZATCA regulations.

Our team assesses Dynamics 365 Finance and Operations’ current capabilities to identify gaps and opportunities for alignment with ZATCA’s Phase 2 (Integration Phase) requirements.

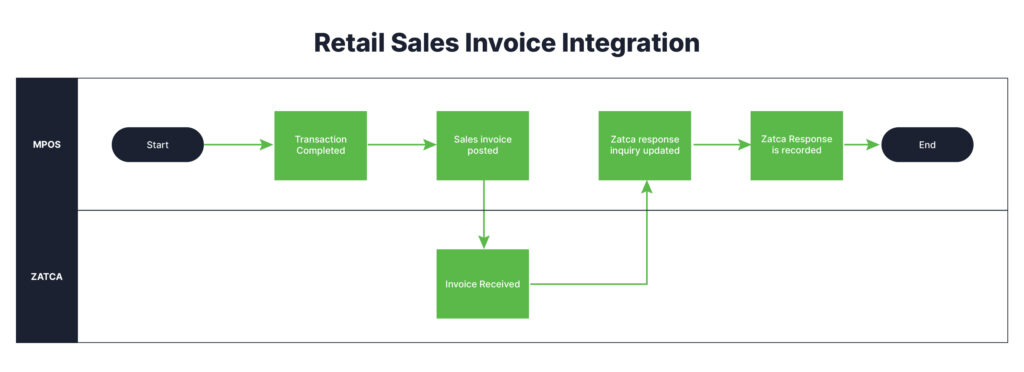

2. Integration of ZATCA with Dynamics 365 using APIs

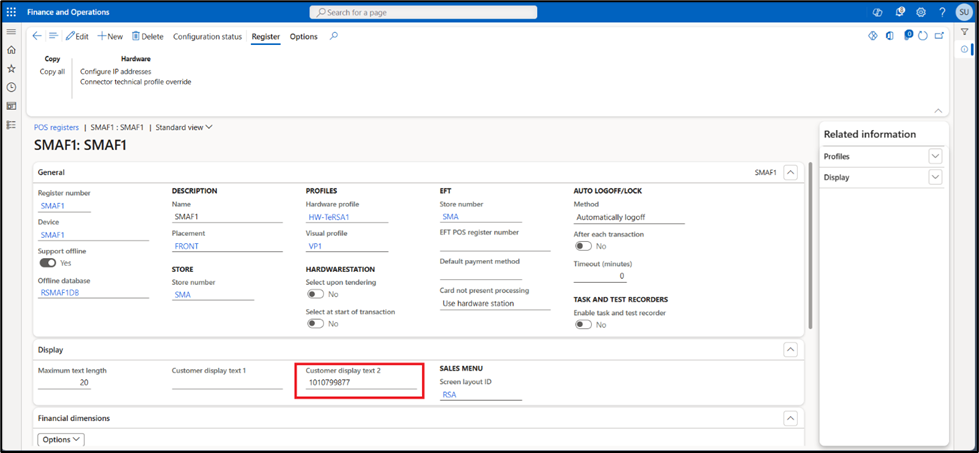

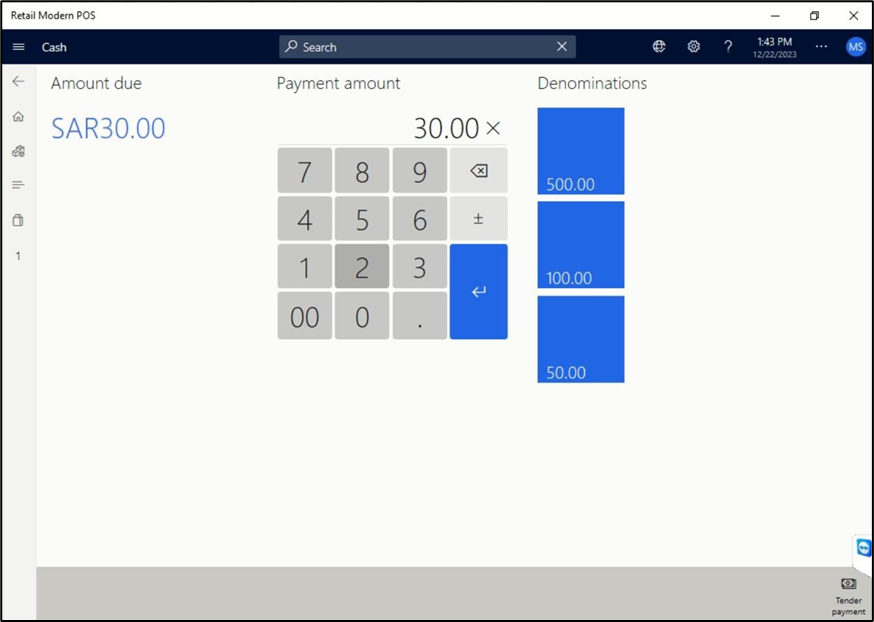

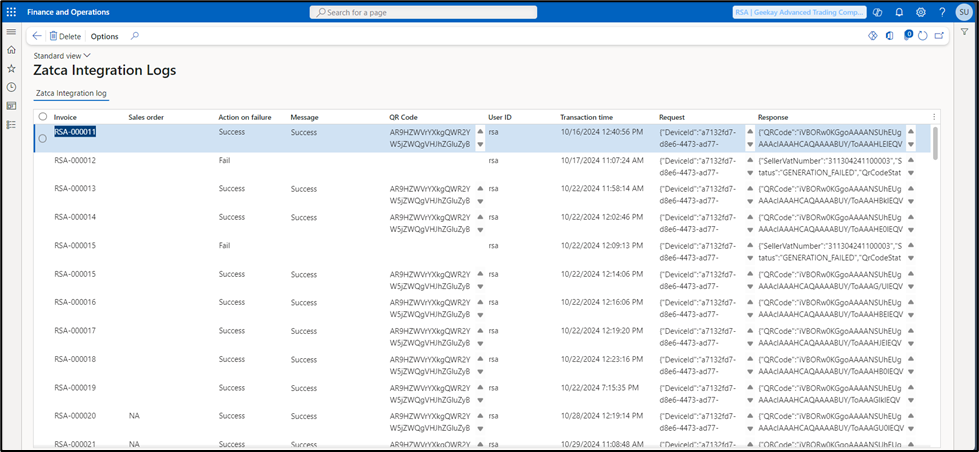

We configure Dynamics 365 to generate invoice data in the mandated XML format. Using secure APIs, we automate the invoice validation and submission process. Our integration ensures QR code generation and digital signatures are embedded according to ZATCA’s technical standards.

3. API communication with ZATCA via ClearTax

Confiz establishes a secure API connection between Dynamics 365 and ZATCA using trusted intermediaries such as ClearTax. We enable real-time invoice transmission through the ZATCA compliance gateway and implement full encryption to meet regulatory security requirements.

4. Testing and validation

Our experts perform rigorous end-to-end testing to verify the integration.

We ensure all invoice submissions meet ZATCA’s compliance standards and address any integration issues proactively to support smooth processing.

5. Deployment and user training

Once the integration is finalized, we deploy the solution within Dynamics 365 across the client’s finance operations. Confiz provides tailored training sessions to finance and IT teams, ensuring they are equipped to manage, monitor, and maintain ZATCA compliance confidently.