Microsoft Dynamics 365 stands as a dominant ERP choice for medium and large enterprises globally. Businesses across various verticals, especially in retail, have extensively benefited from its diverse ERP portfolio, offering a myriad of packages, customizations, deployment models, and flexible pricing.

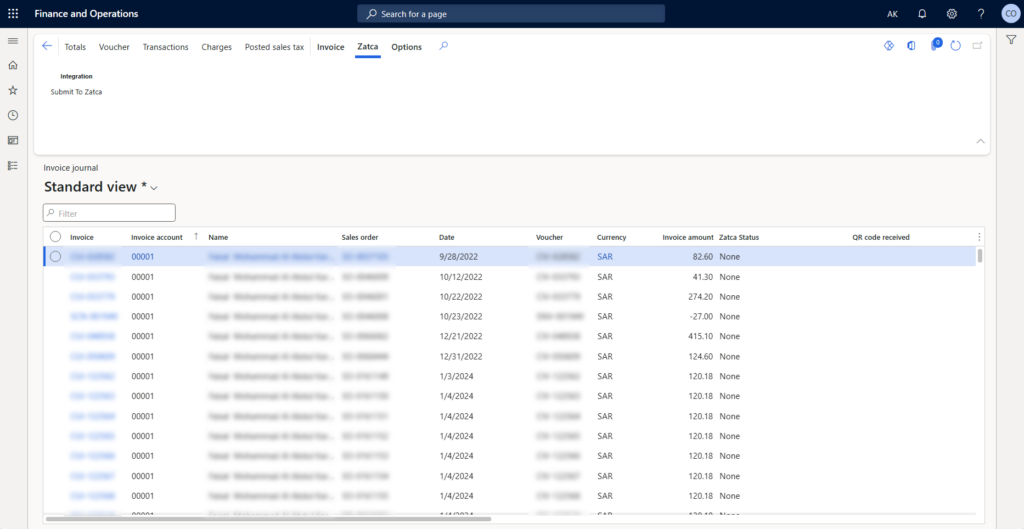

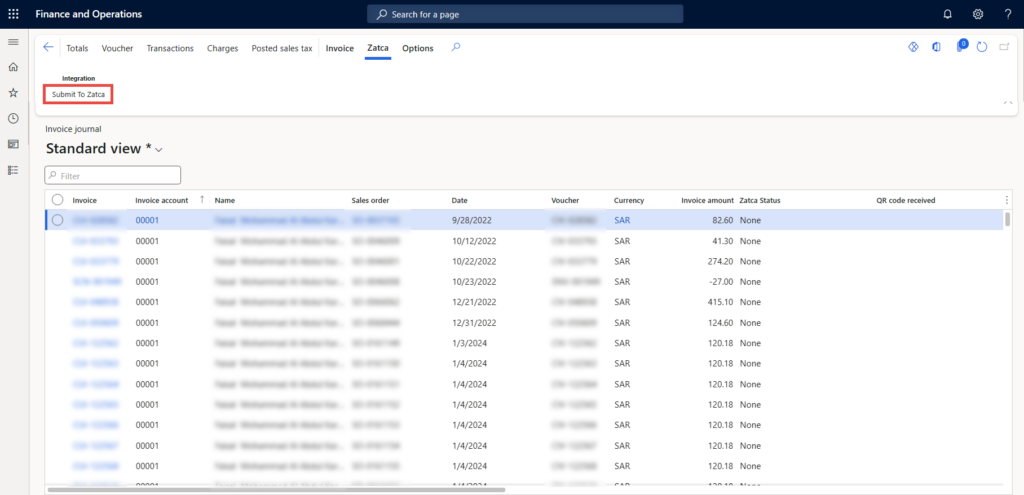

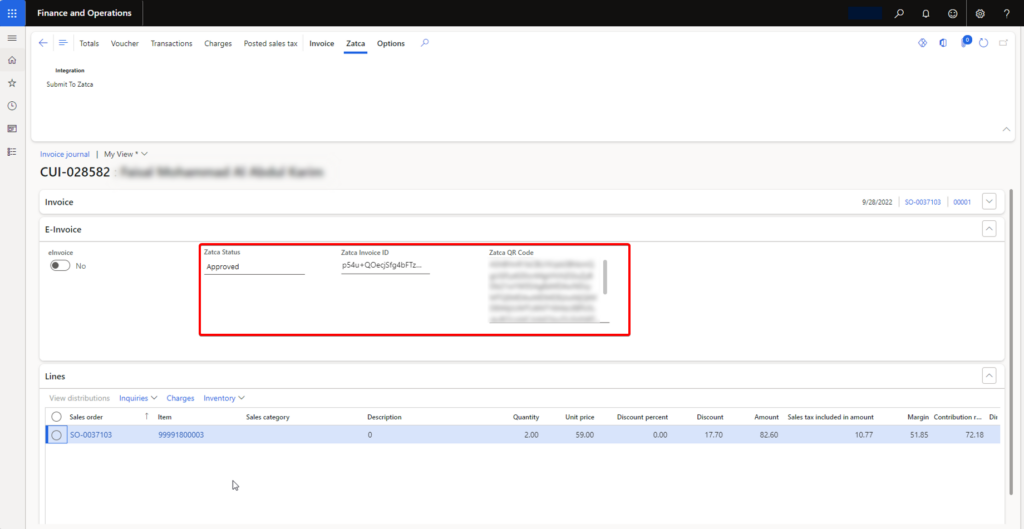

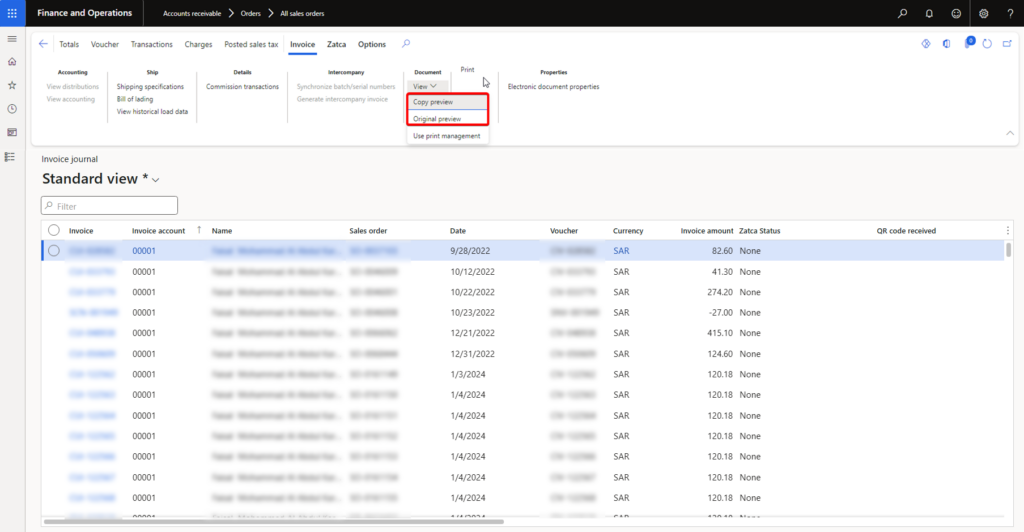

For those managing retail and business operations through Microsoft Dynamics 365 Finance and Operations and operating in Saudi Arabia, it’s high time to gear up for seamless integration with FATOORA (ZATCA’s e-invoicing portal).

Wondering where to begin? This blog is the first part of a comprehensive two-part series, providing a detailed guide on integrating Dynamics 365 Finance and Operations with ZATCA. Follow our step-by-step guide for onboarding with ZATCA and generate e-invoices for your B2B and e-commerce customers. Stay tuned for the second part, where we’ll walk you through the steps to integrate ZATCA with your MPOS and effortlessly generate e-invoices for B2C customers.

Understanding ZATCA invoicing in Saudi Arabia

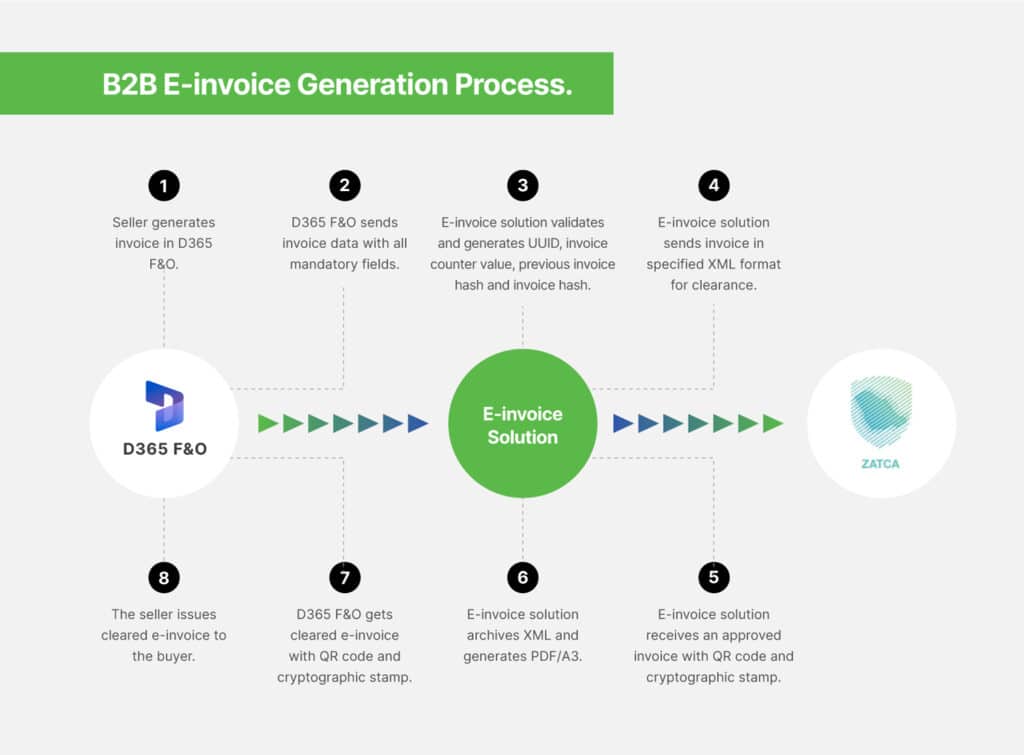

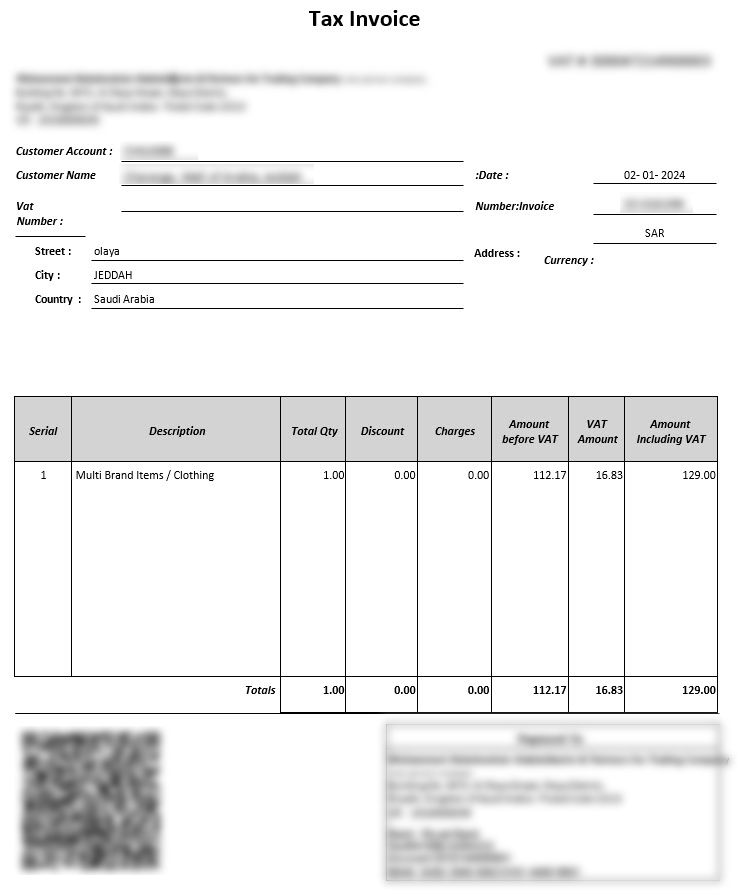

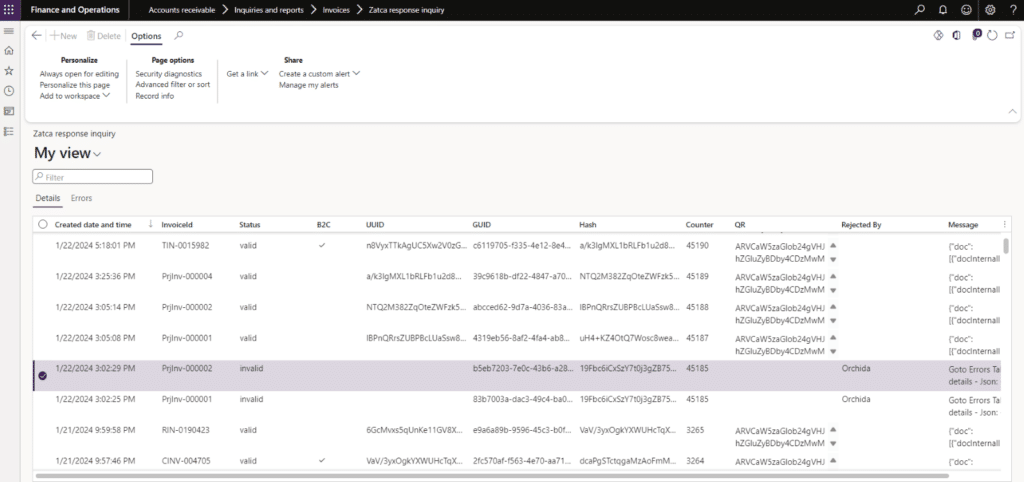

The Zakat, Tax, and Customs Authority (ZATCA) implemented an e-invoicing law starting December 4, 2021. Whether you’re a registered supplier, distributor, or retailer, you must prepare and comply with the e-invoicing process. Sending customer invoices to the tax authority before issuing them to the customer is a regulatory requirement. There are two phases involved in the process as defined by ZATCA Saudi Arabia:

- Phase 1 | Generation: Electronically generate and issue invoices in the specified ZATCA format.

- Phase 2 | Integration: Report the generated invoices to ZATCA