The General Ledger (GL) foreign currency revaluation feature in D365FO plays a key role in ensuring accurate financial reporting. When GL accounts hold balances in different currencies, fluctuating exchange rates can quickly affect how those balances appear in financial statements.

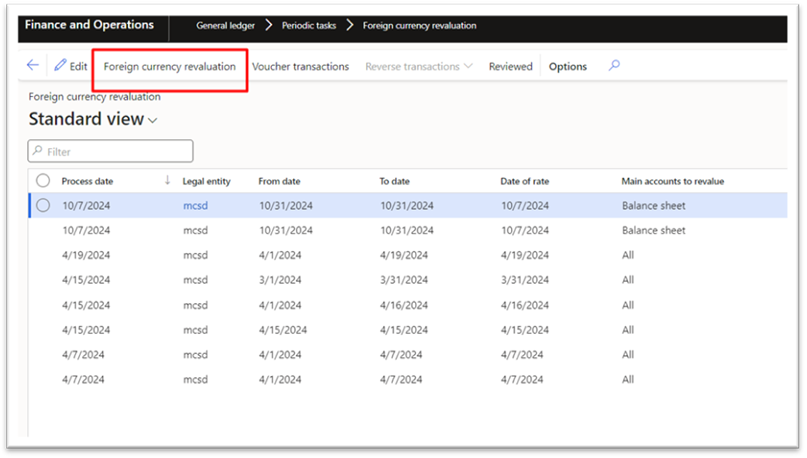

This process allows organizations to revalue designated main accounts, update them to the latest exchange rates, and automatically post the necessary foreign currency revaluation accounting entries. In doing so, it reduces risk, improves compliance with international accounting standards, and provides finance teams with reliable, audit-ready records.

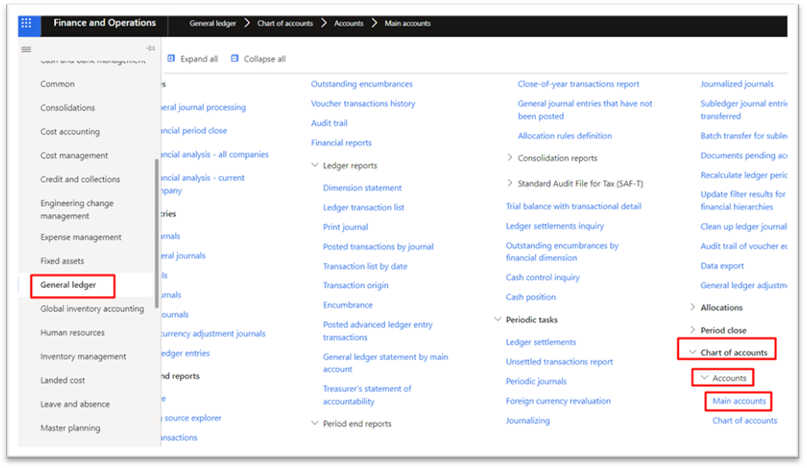

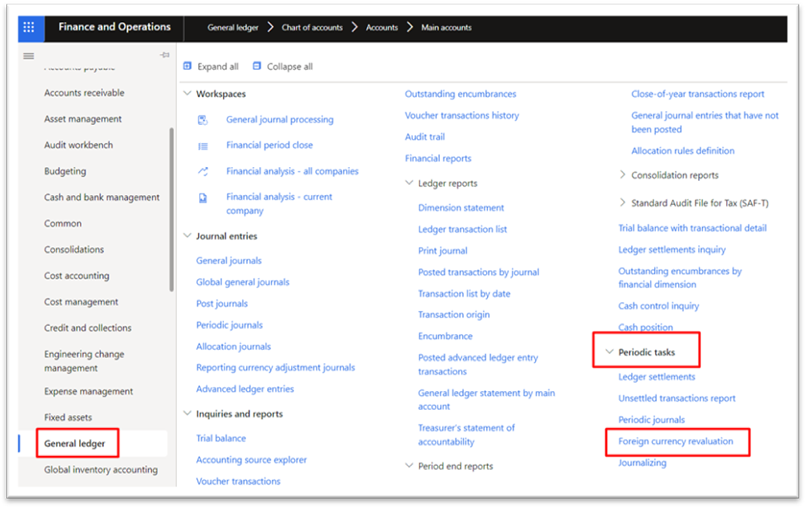

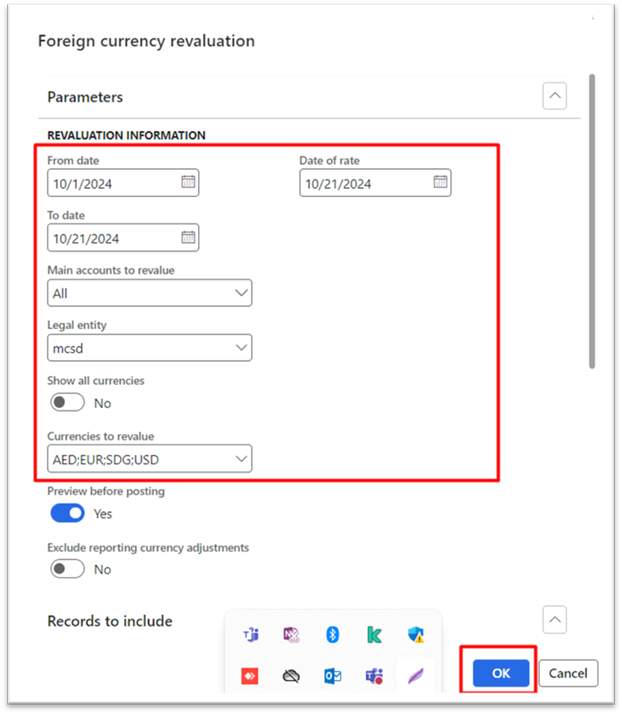

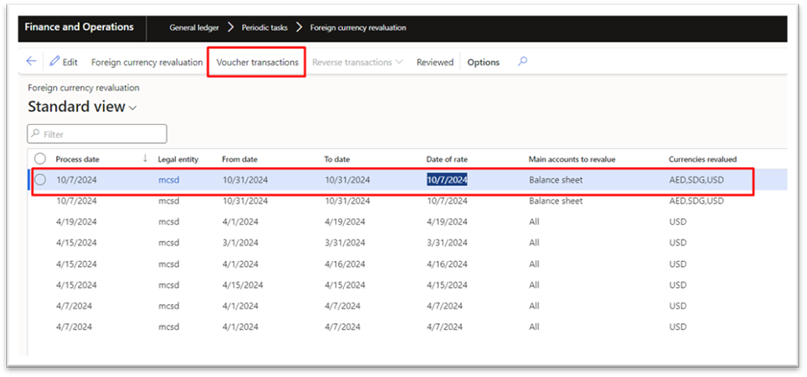

In this final part of our foreign currency revaluation series, we’ll walk through how to set up and run the General Ledger revaluation in D365FO, review the resulting entries, and understand their impact.

What is General Ledger foreign currency revaluation?

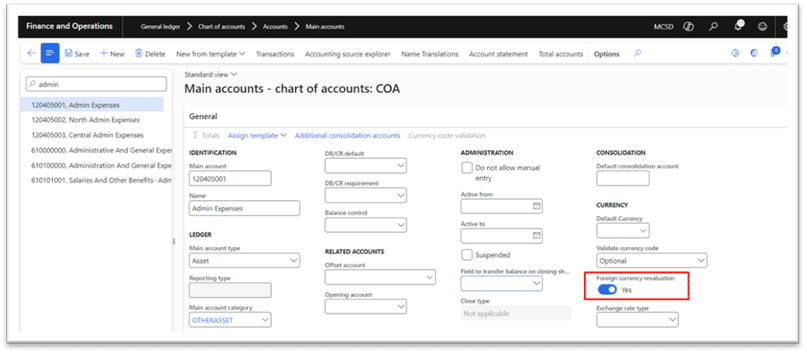

Foreign currency revaluation in D365 for the General Ledger updates balances for accounts marked for revaluation. By doing so, organizations ensure that foreign currency assets and liabilities are always reported using the most recent exchange rates.

The system automatically generates foreign currency revaluation accounting entries, eliminating manual errors and providing clear audit trails. This enables finance teams to remain compliant with IFRS and GAAP while maintaining accurate financial statements.

Read more: Getting started with Foreign Currency Revaluation in Dynamics 365 F&O