Accurate management of foreign currency balances is essential for organizations working across multiple currencies. Fluctuating exchange rates can affect customer balances, revenue recognition, and overall financial reporting. Ensuring that foreign currency assets and liabilities are accurately valued at period-end is a crucial aspect of maintaining compliance and financial accuracy.

Dynamics 365 Finance & Operations streamlines this process through its foreign currency revaluation functionality for Accounts Receivable (AR). By automating calculations, posting the required foreign currency revaluation accounting entries, and ensuring clear audit trails, D365 reduces manual work and mitigates currency-related risks.

Building on the concepts covered in our earlier discussion on Accounts Payable (AP) revaluation, this second blog in our series focuses on how Accounts Receivable foreign currency revaluation works in Dynamics 365 F&O – covering execution, posting logic, and reviewing the impact on customer accounts.

Steps to perform AR foreign currency revaluation in Dynamics 365 F&O

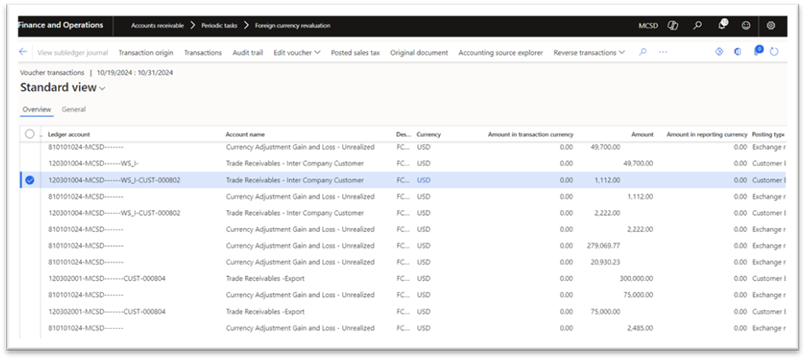

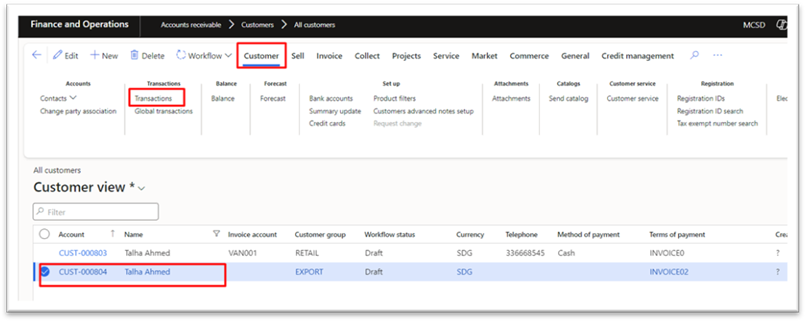

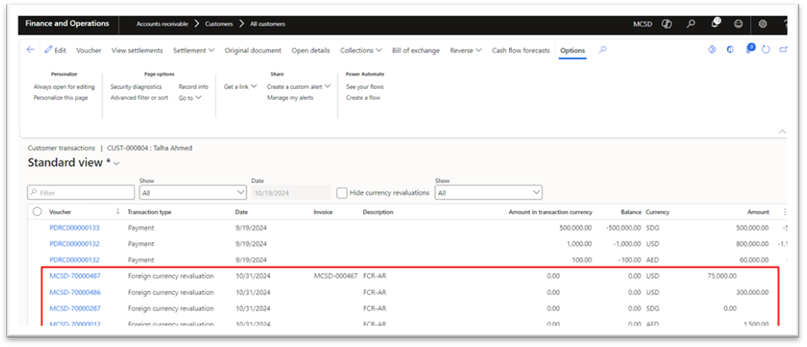

The foreign currency revaluation in D365FO process for Accounts Receivable follows a similar approach to Accounts Payable. The system revalues all open-minded customer transactions using the specified exchange rate, posting foreign currency revaluation accounting entries to reflect unrealized gains or losses.

Step 1: Run AR foreign currency revaluation

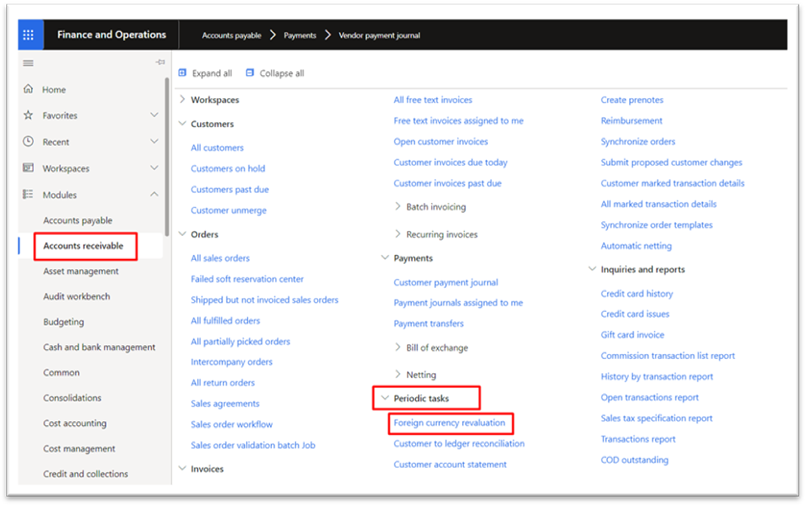

- Go to Accounts Receivable > Periodic Task > Foreign Currency Revaluation

- Select Foreign Currency Revaluation from the options.

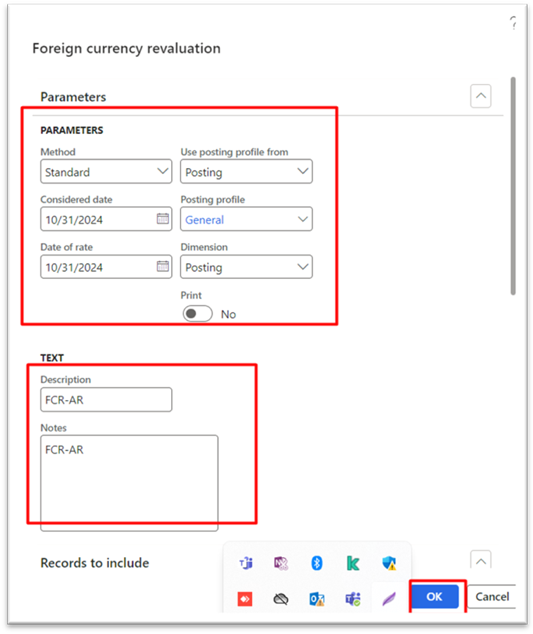

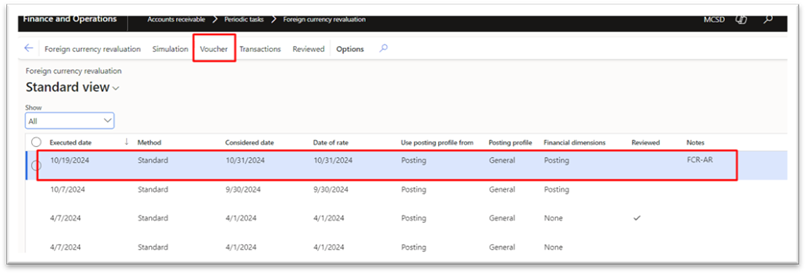

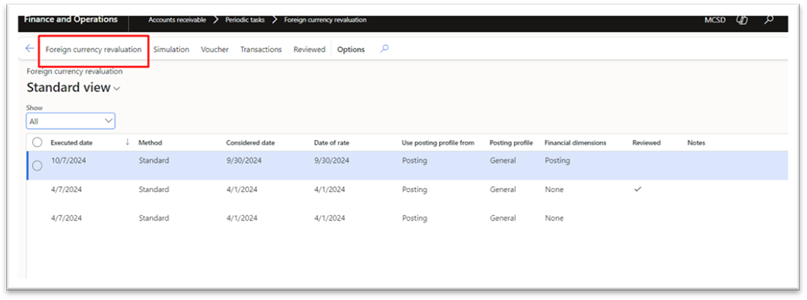

- Give relevant details such as method, considered date, date of rate, use posting profile from, posting profile, dimension, description, notes, etc.

- After entering all details, click on Ok. The FCR will be posted.