Financial reconciliation is critical for ensuring the accuracy of financial records, identifying discrepancies, and maintaining compliance with regulatory standards. However, it can be time-consuming and prone to human error, especially in large organizations with complex financial data.

To address these challenges, the integration of Copilot for Finance in the reconciliation process has emerged as a game-changer. By combining automation with AI-powered insights, Copilot for Finance simplifies reconciliation tasks that would otherwise take hours or even days. It empowers finance teams to shift from manual validation to strategic analysis, helping businesses close books faster, reduce operational risk, and make more informed decisions.

Read more: New to Copilot for Finance? Discover how it can streamline & enhance your financial operations.

Reconciling data with Microsoft Copilot for Finance: How to get started?

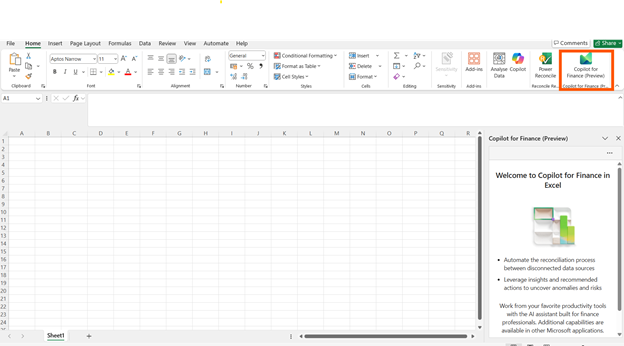

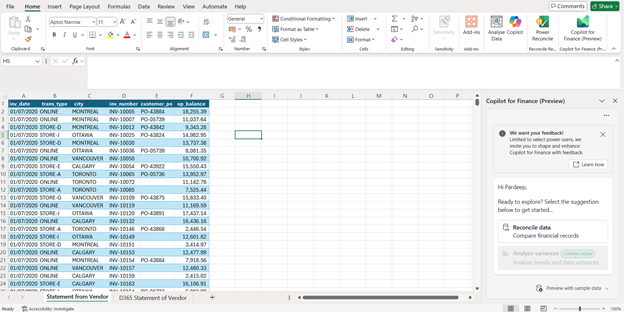

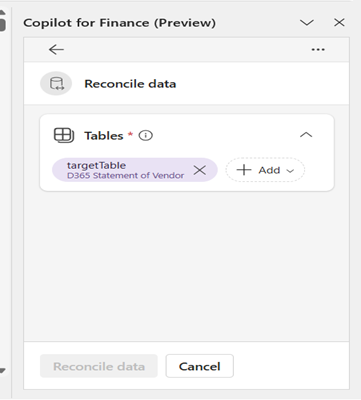

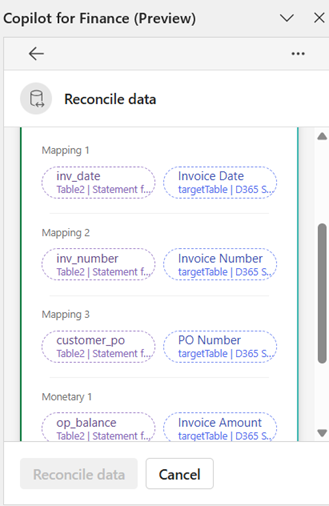

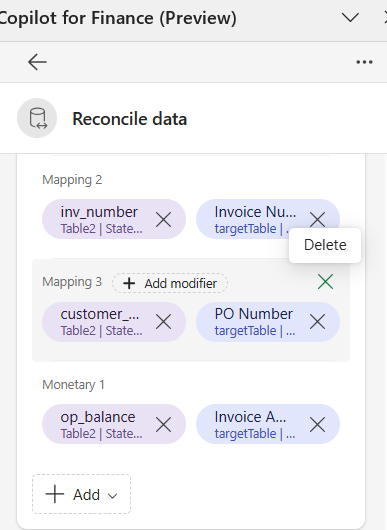

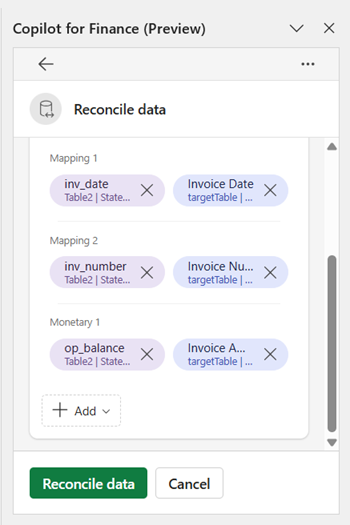

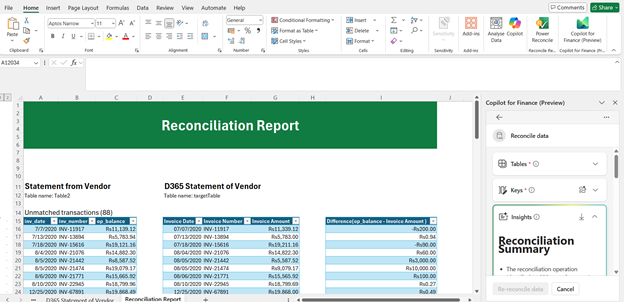

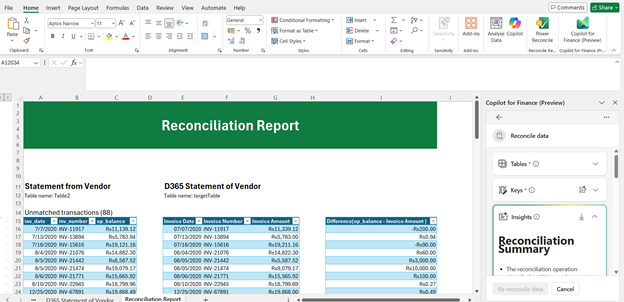

Data reconciliation in Microsoft Copilot for Finance simplifies reconciling two data sets in Excel workbooks. You can define the data to reconcile, use AI to determine the reconciliation rules, and benefit from a comprehensive report that provides a generative AI summary of the reconciliation process’s results.

Curious about how Copilot for Finance can help with data reconciliation? Check out these use cases:

- Comparing the Vendor statement with the Dynamics 365 vendor account.

- Comparing the bank statement with the Dynamics 365 bank account statement.

- Reconciling subledger to ledger entries in Dynamics 365.

Prerequisites for using this feature

- Copilot for Finance license and user access

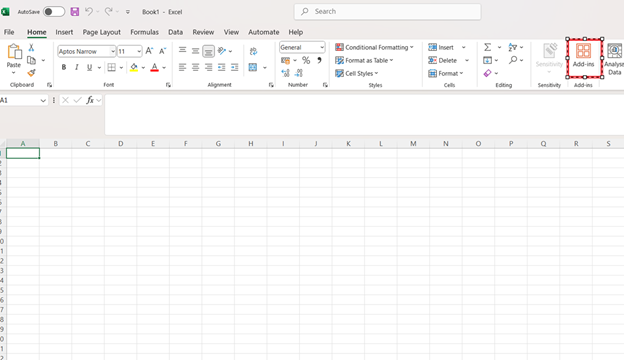

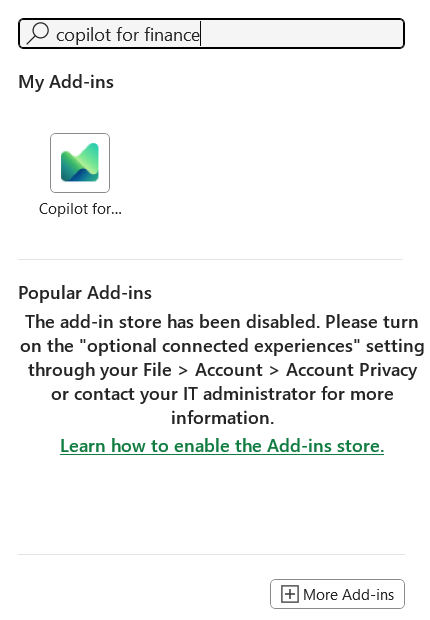

- Copilot for Finance add-in installed in Excel

Now, let us explain these steps to help you get started.

Further readings: Using Copilot for Finance in Outlook for financial conversations