Managing capital expenditure can be a complex task for finance teams. Without the right tools, organizations often struggle to track asset budgets, align capital planning with business goals, and maintain visibility over future spending. This can lead to budget overruns, limited financial control, and missed opportunities for optimizing investments.

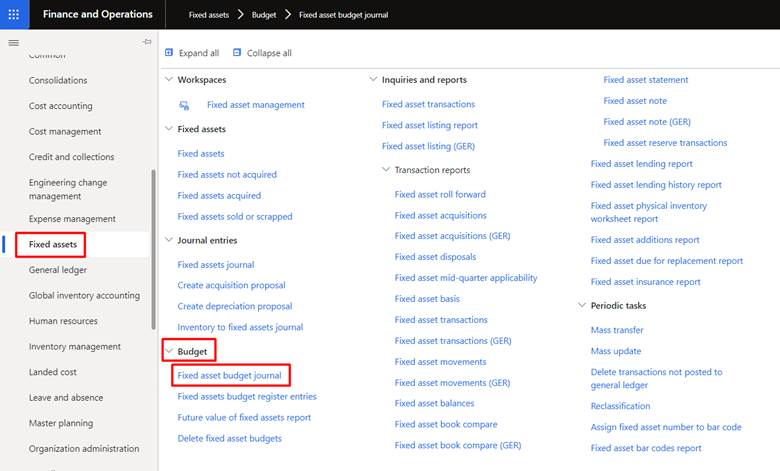

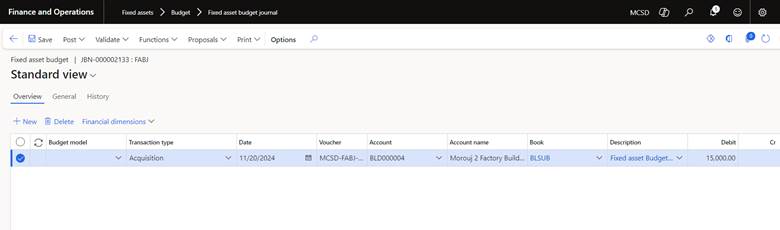

The Fixed Asset Budget Journal in Dynamics 365 Finance & Operations addresses these challenges by providing a structured and centralized framework for managing fixed asset budget in D365. With this feature, businesses can:

- Plan and allocate budgets for fixed asset acquisitions in advance

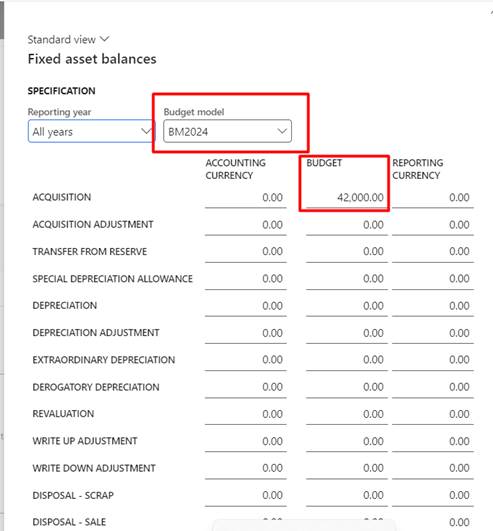

- Maintain financial control by monitoring capital expenditure against approved budgets

- Improve cash flow forecasting with visibility into future depreciation

- Integrate budgeted amounts into the organization’s financial framework for better reporting

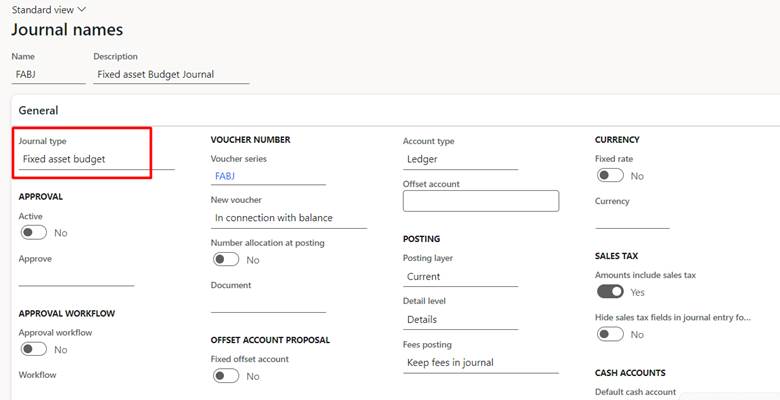

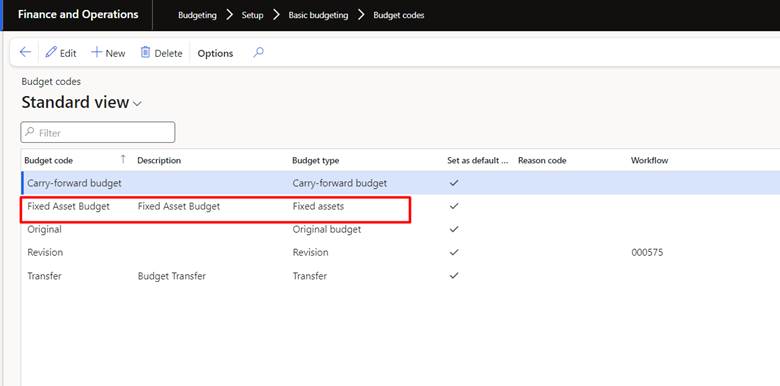

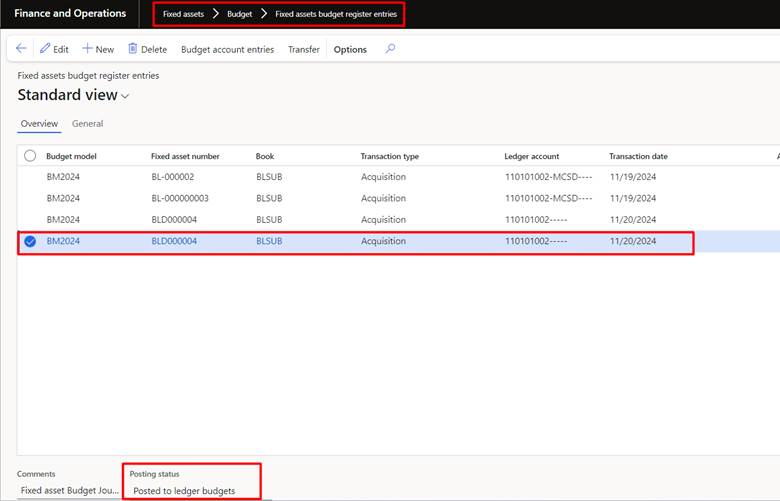

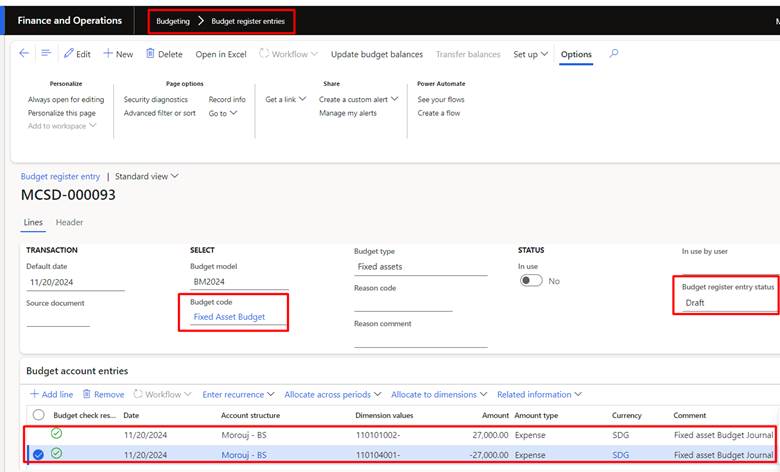

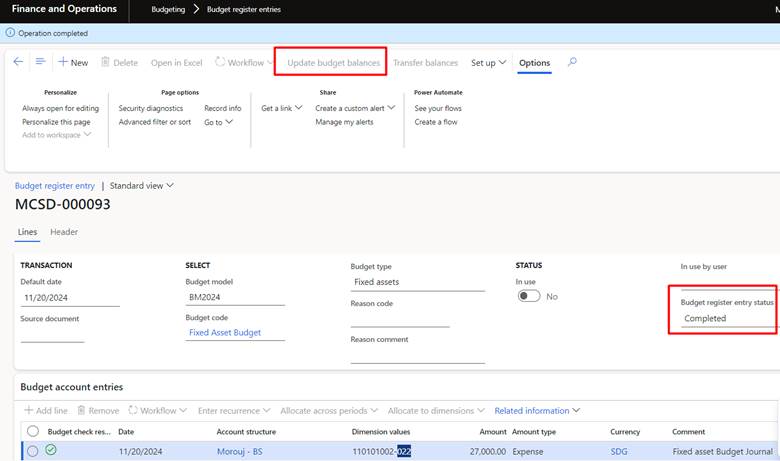

This blog explores how to set up and use the Fixed Asset Budget Journal in Dynamics 365 Finance & Operations, covering prerequisites, posting options, budget register integration, and budget control scenarios.

Key benefits of using Fixed Asset Budget Journal

The Fixed Asset Budget Journal in Dynamics 365 Finance and Operations streamlines capital expenditure planning, offering enhanced control and better budget accuracy. It ensures finance teams can effectively track, manage, and forecast asset investments. Below are the key benefits of using this journal to improve financial planning and decision-making.

1. Strategic capital planning

The Fixed Asset Budget Journal enables finance teams to strategically plan and allocate budgets for fixed asset acquisitions, aligning with both short-term financial goals and long-term business objectives. By forecasting asset investments in advance, businesses can ensure they are making informed decisions that drive growth and support organizational priorities.

2. Enhanced financial control

By forecasting fixed asset expenditures before actual spending occurs, the Fixed Asset Budget in D365 Journal provides greater oversight and governance. This proactive approach enables businesses to maintain control over their capital investments, preventing budget overruns and facilitating more effective management of financial resources.

3. Visibility into future depreciation

Planning for future depreciation is a crucial aspect of capital budgeting. With the Fixed Asset Budget Journal, businesses gain visibility into how new asset investments impact future depreciation expenses, enabling more accurate cash flow forecasting and enhanced financial planning.

4. Improved budget accuracy

The Fixed Asset Budget Journal encourages realistic, data-driven budgeting by using historical asset data and business growth projections. This approach leads to more accurate capital forecasting, ensuring that budgets reflect both past trends and future business requirements.

5. Streamlined approval process

Integrated with financial workflows, the Fixed Asset Budget Journal speeds up the approval process for capital investment budgets. Finance teams can quickly review and approve budget proposals, improving internal efficiency and reducing delays in the capital planning cycle.