Advanced bank reconciliation setup in D365 Finance allows you to import electronic bank statements and automatically match them with bank transactions recorded in the system, streamlining the reconciliation process.

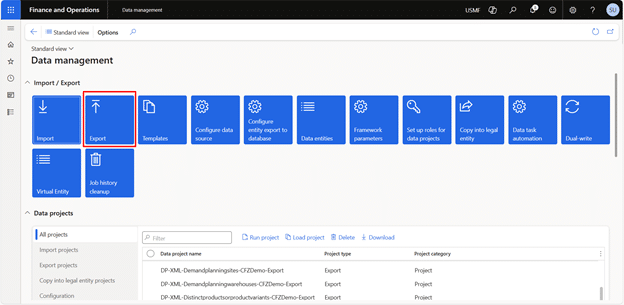

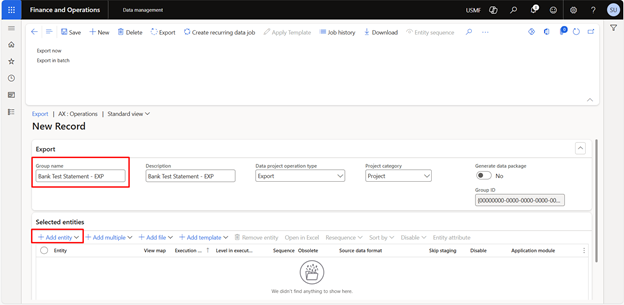

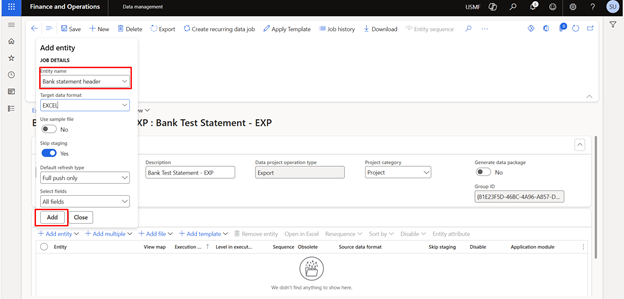

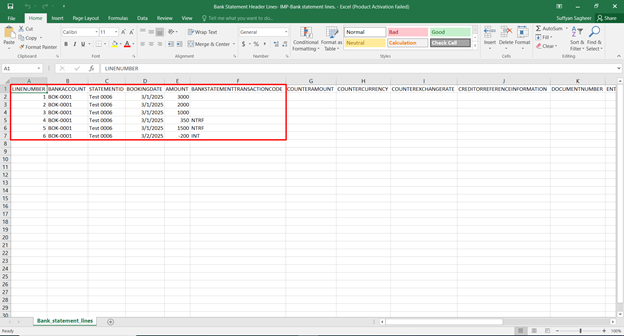

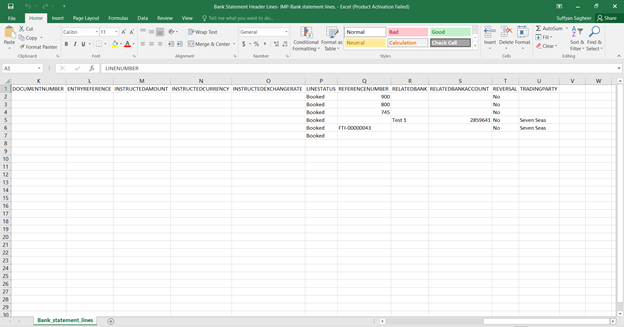

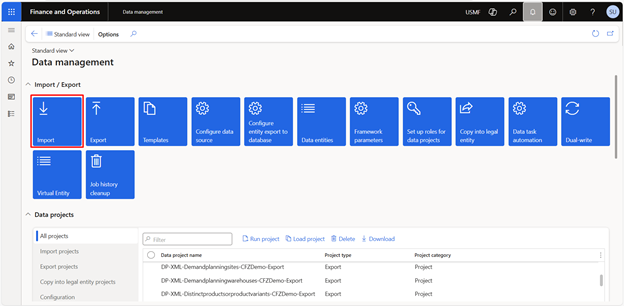

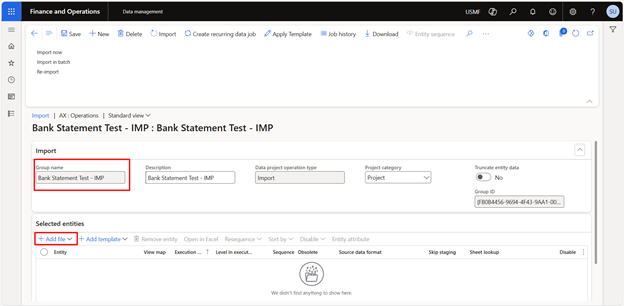

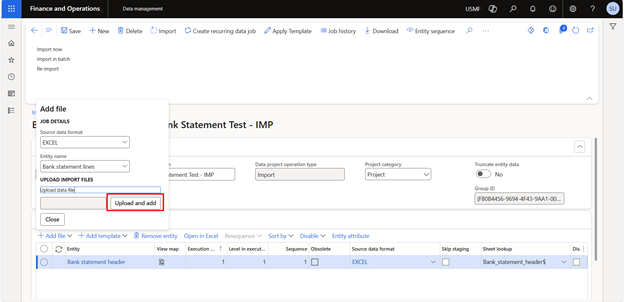

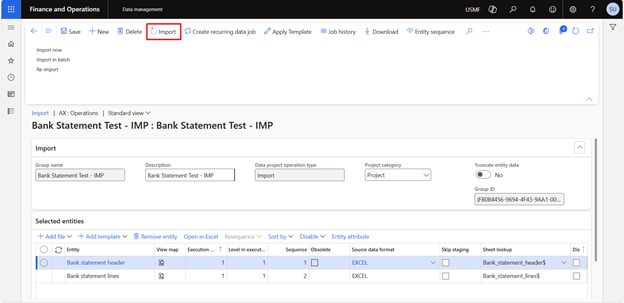

Microsoft Dynamics 365 Finance simplifies this task with its Data Management Framework, allowing seamless Excel-based bank statement imports. Traditionally, businesses relied on the MT940 format, but with recent advancements in the 10.0.40 version and onwards, Dynamics 365 supports Excel imports, offering greater flexibility and ease of use.

This article outlines the reconciliation process in Dynamics 365 Finance, highlighting best practices and the benefits of improving your banking operations.

What is bank reconciliation?

Bank reconciliation is the process of comparing and matching the transactions recorded in a company’s accounting records with the transactions shown on its bank statement. This helps ensure accuracy by identifying discrepancies, errors, or missing entries, and confirms that the cash balances are correct.

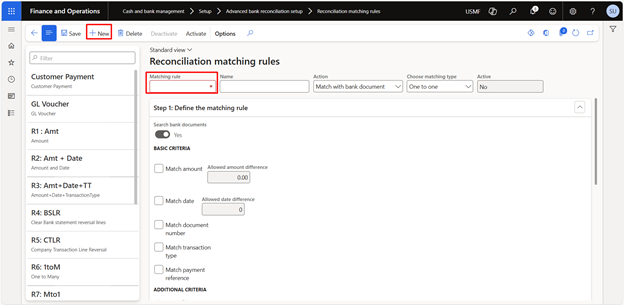

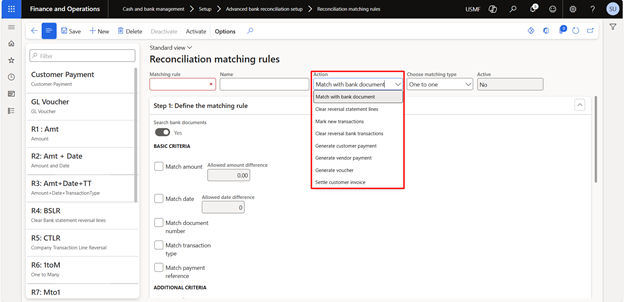

How to do bank reconciliation in Dynamics 365 Finance?

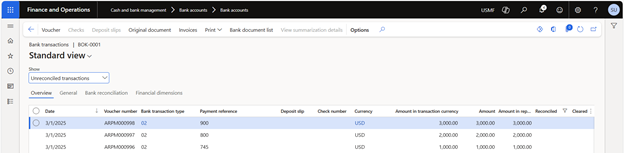

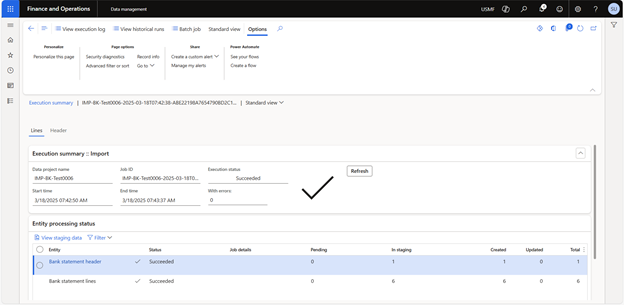

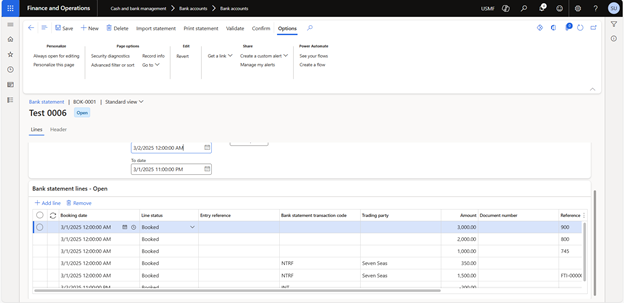

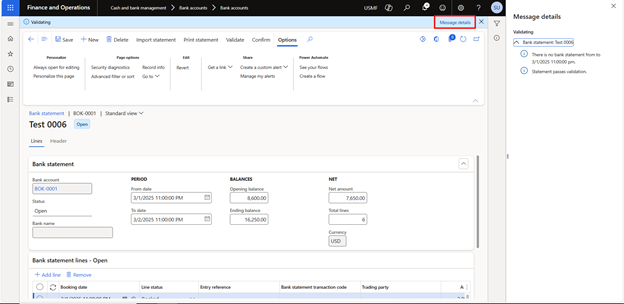

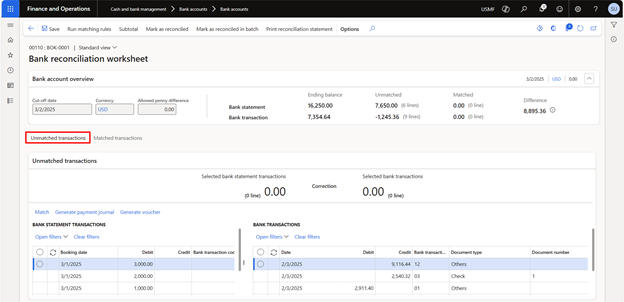

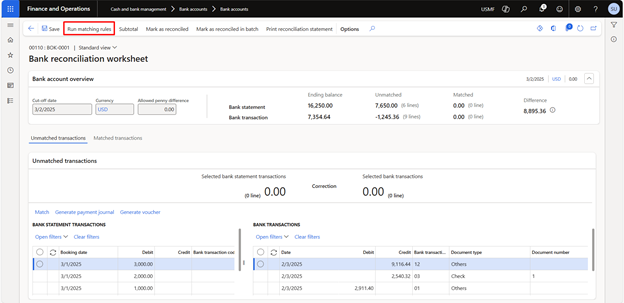

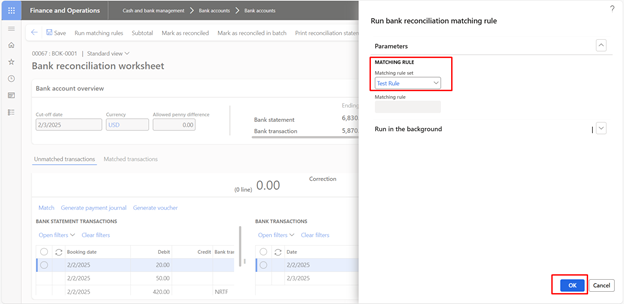

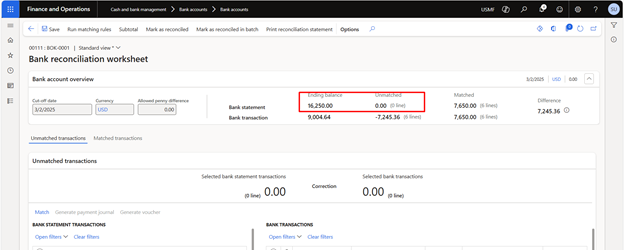

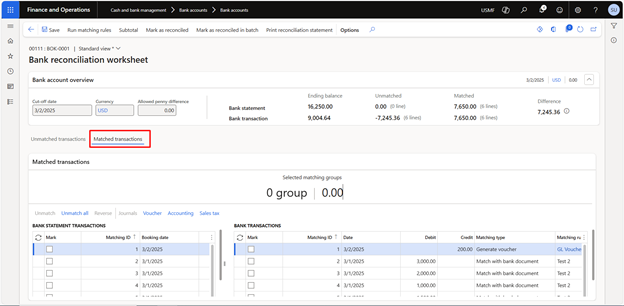

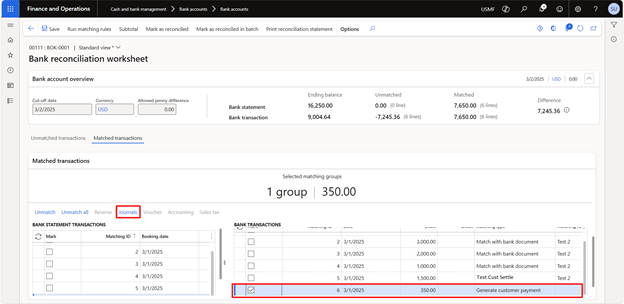

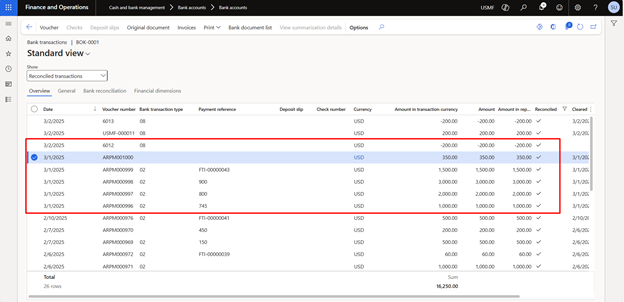

In Dynamics 365 Finance, bank reconciliation is done by importing electronic bank statements, either via file upload or direct integration. The system automatically matches bank transactions with ledger entries based on predefined rules. Users review and confirm unmatched transactions to complete the reconciliation process.

Setting up advanced bank reconciliation in Dynamics 365 Finance: A system walkthrough

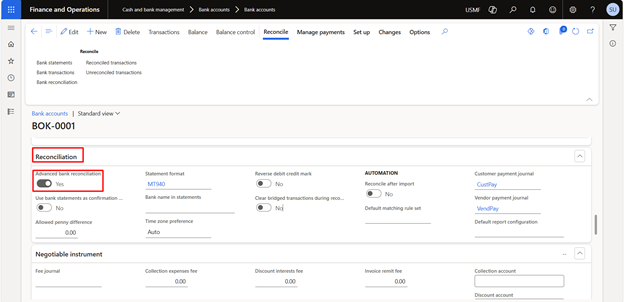

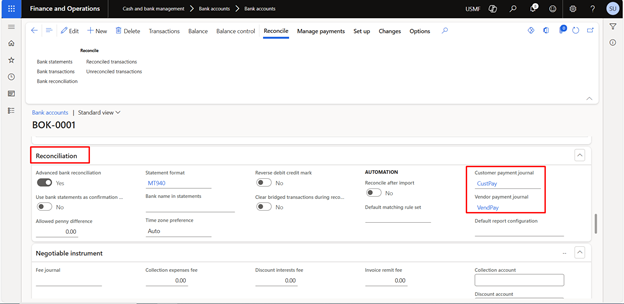

First, we must mark the advance bank reconciliation flag on the bank master form as “Yes.”

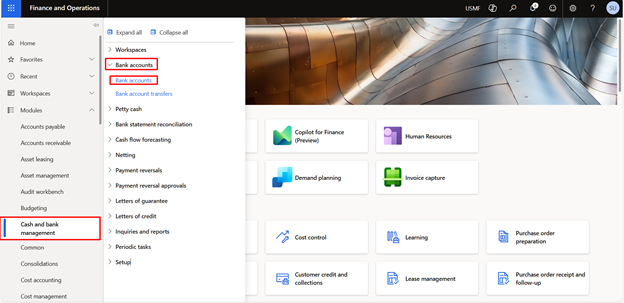

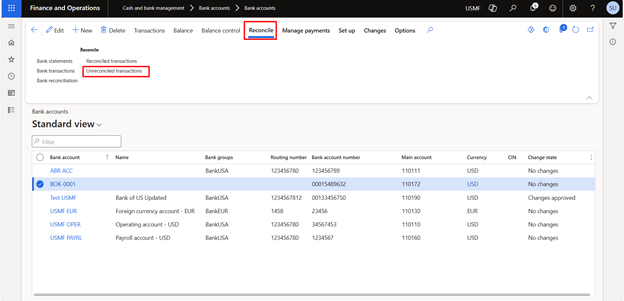

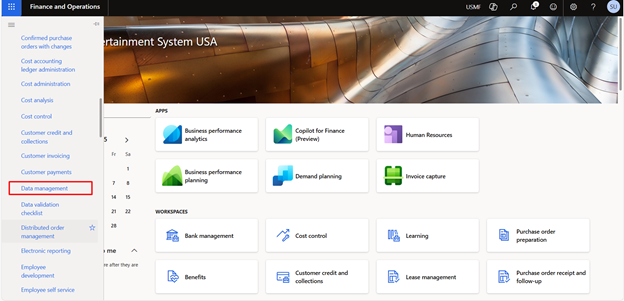

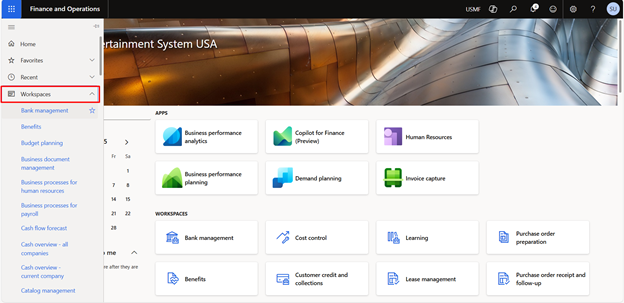

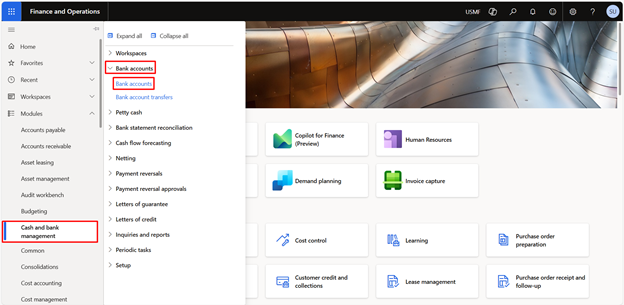

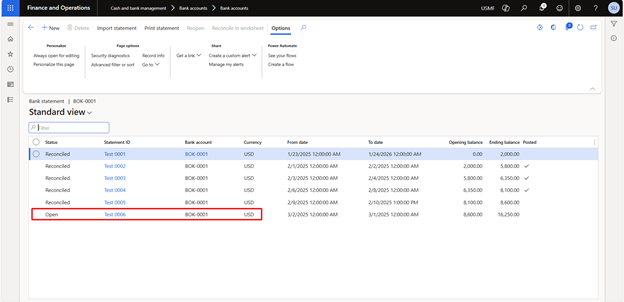

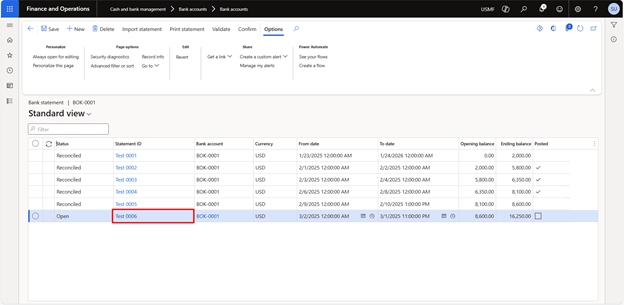

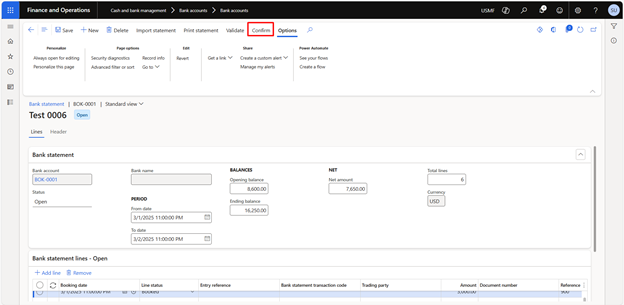

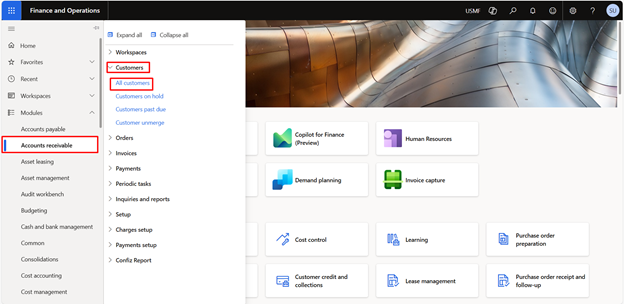

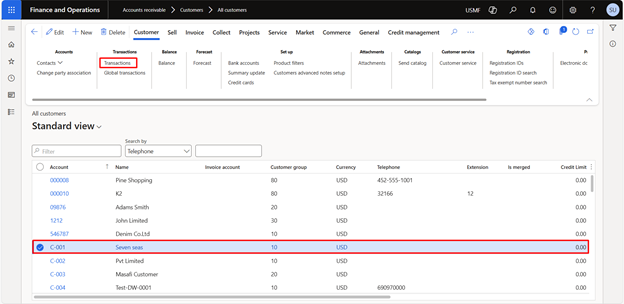

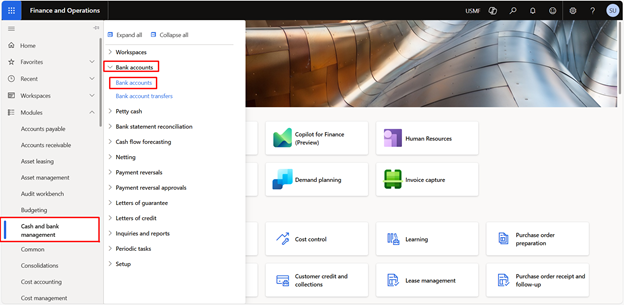

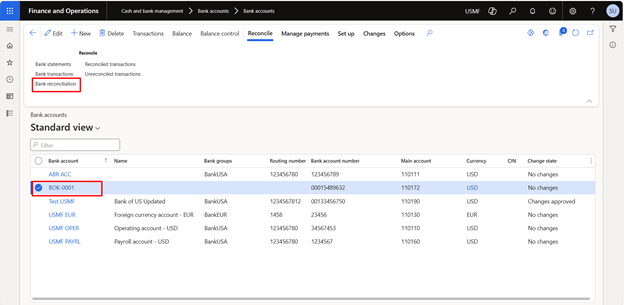

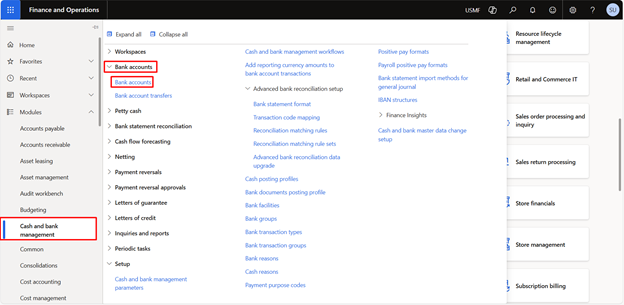

Navigate to Modules > Cash and Bank > Bank accounts.

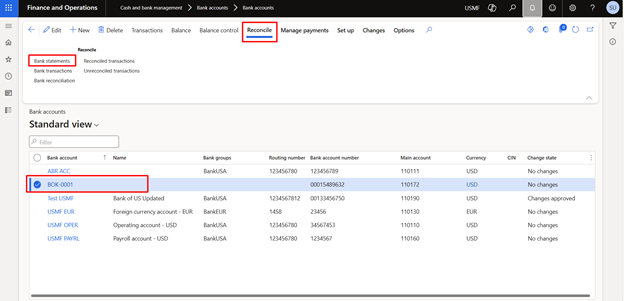

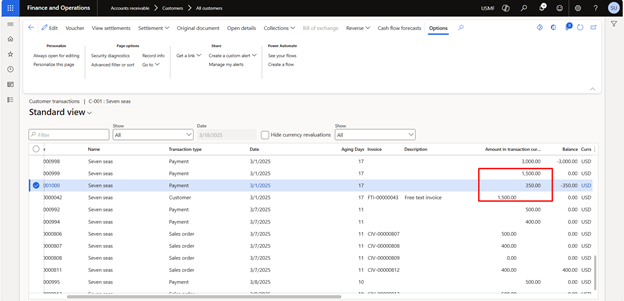

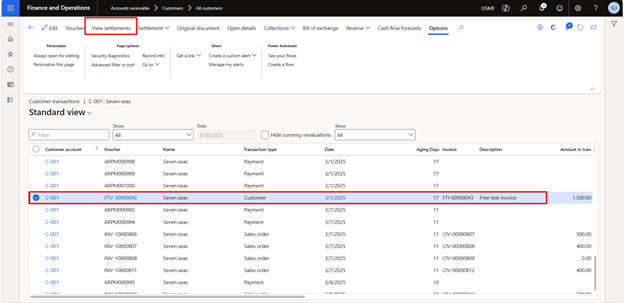

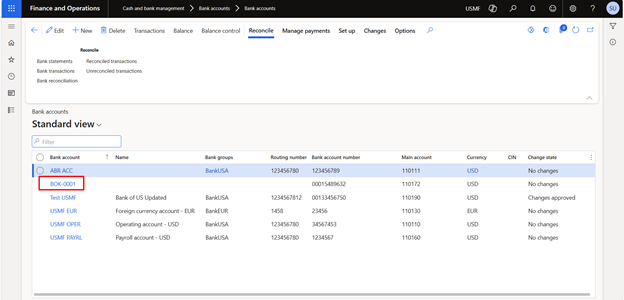

Select the relevant bank account.

Under the reconciliation tab, mark the advance bank reconciliation flag as “Yes.”

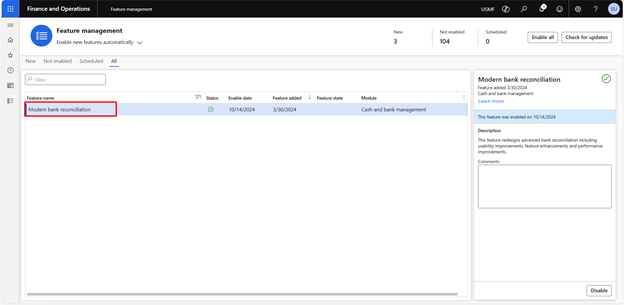

We have enabled the modern bank reconciliation feature from the feature management workspace. This feature is available in the 10.0.40 version.

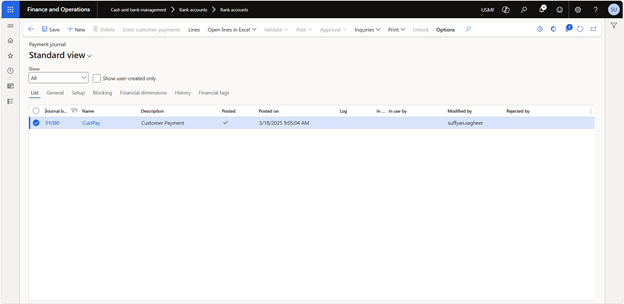

Similarly, add the customer payment journal and the vendor payment journal if there are payments that are required to be made/received on the bank master.

Note: We have enabled the Modern Bank Reconciliation feature from the Feature Management workspace. However, from version 10.0.40 onwards, Excel import can also be performed using Advanced Bank Reconciliation.

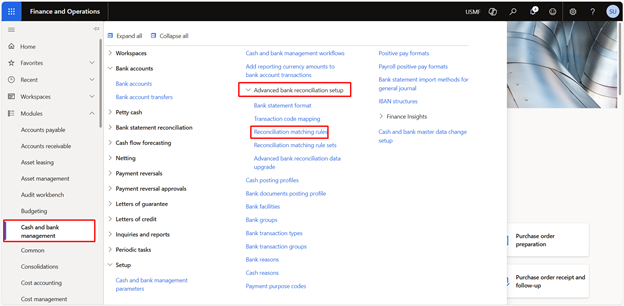

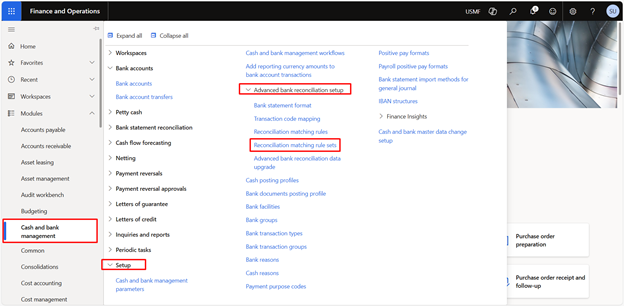

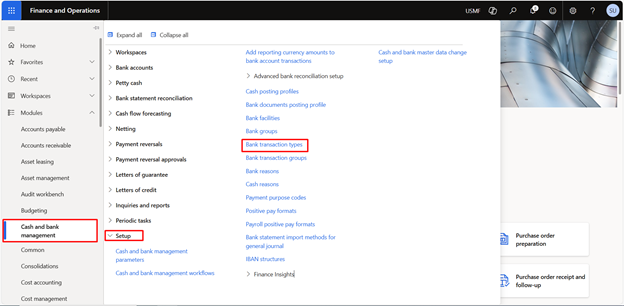

Now, we will set up the bank transaction types. For that, navigate to:

Modules > Cash and Bank Management > Setup > Types

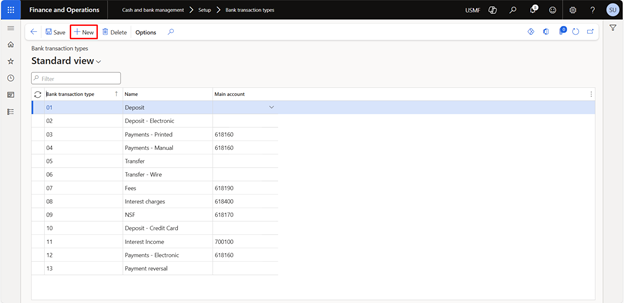

Click New and add the transaction type. Select the main account if any required:

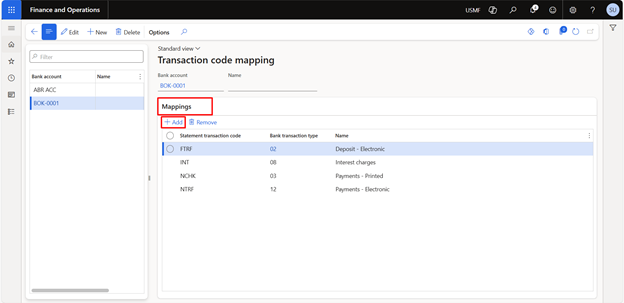

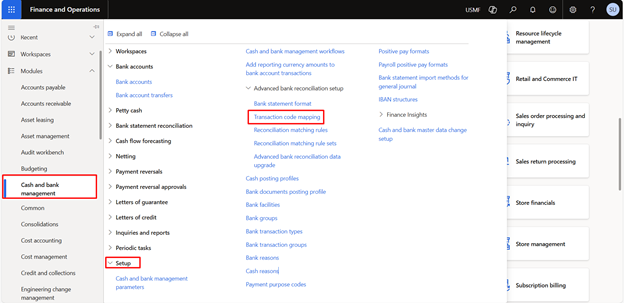

We can map the bank statement transaction code with the bank transaction type as well.

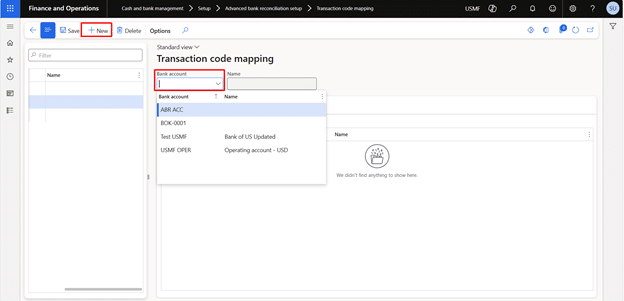

For that, navigate to:

Modules > Cash and Bank Management > Setup > Transaction code mapping

Click New, and in the dropdown, the system will only show the bank accounts on which the advanced bank reconciliation is marked as “Yes.”

Select the relevant bank account, and under the mapping tab, add the details.