For organizations managing bank accounts in multiple currencies, exchange rate movements can create unexpected shifts in reported cash balances. Even small fluctuations can distort financial results, making it harder to present an accurate picture at the end.

Handling this manually often leads to inefficiencies and inconsistencies. For D365F&O users, the good news is that this ERP includes a dedicated cash & bank foreign currency revaluation feature. It automatically adjusts balances using the latest exchange rates and posts the necessary foreign currency revaluation accounting entries, reducing effort while improving accuracy.

Using this feature, finance teams can gain reliable reporting, better control over foreign currency assets, and clear audit trails that stand up to scrutiny.

This is the third blog in our series on foreign currency revaluation in Dynamics 365 F&O. In Part 3, we’ll focus specifically on:

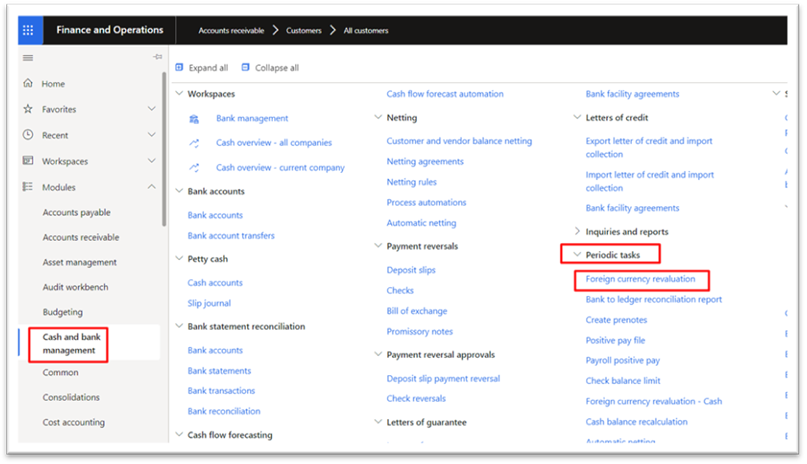

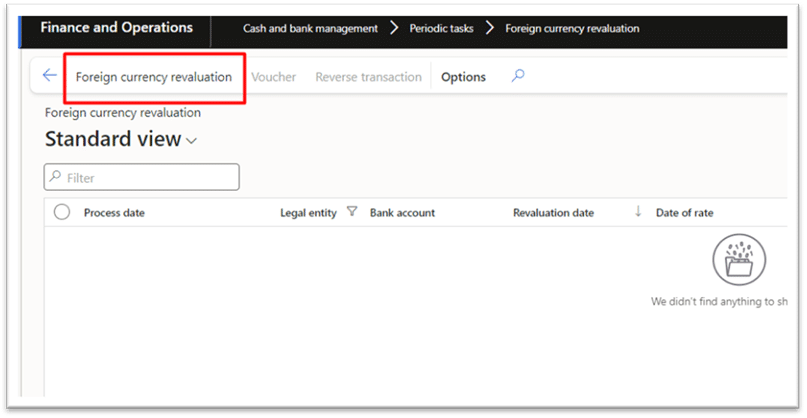

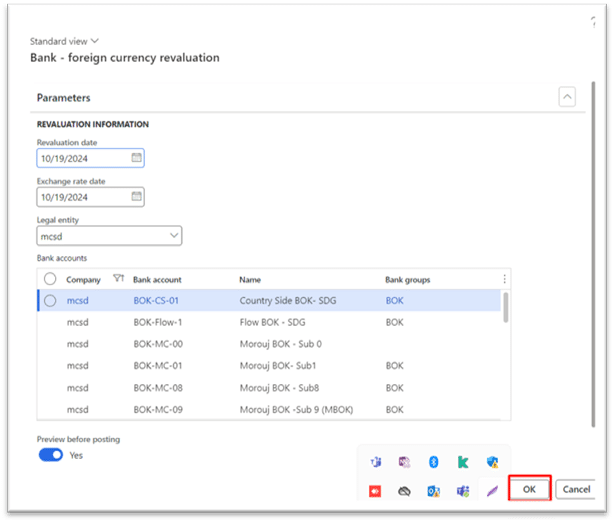

- Running Cash & Bank revaluation in D365FO

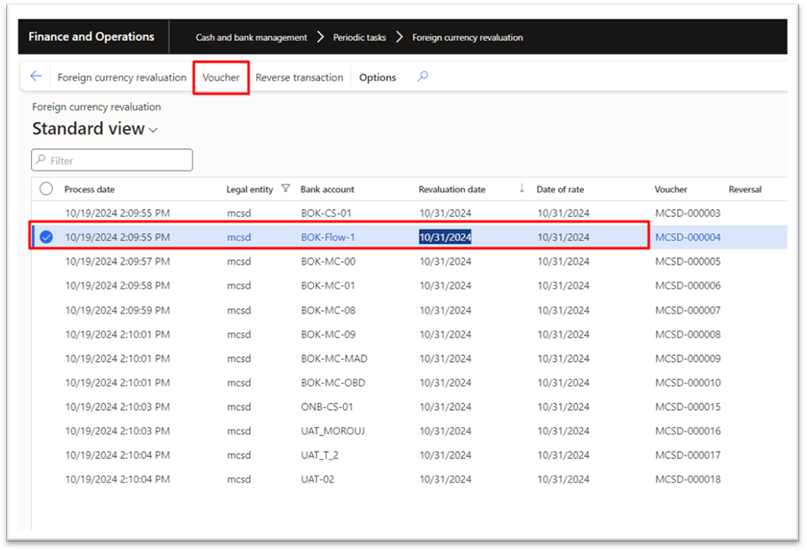

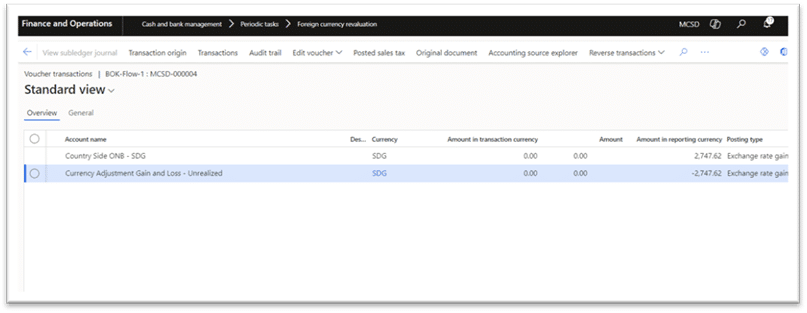

- Reviewing vouchers generated by the process

- Understanding how unrealized gains and losses are posted

Cash & bank foreign currency revaluation explained

The cash & bank revaluation feature in D365 Finance & Operations is designed to revalue bank accounts held in foreign currencies. It ensures that balances are updated to reflect current exchange rates, helping finance teams present accurate foreign currency assets and liabilities while minimizing risks from currency fluctuations.

By automating the creation of foreign currency revaluation accounting entries, this functionality eliminates manual errors, strengthens compliance with IFRS and GAAP, and provides complete transparency through audit-ready vouchers.

Read more: Getting started with Foreign Currency Revaluation in Dynamics 365 F&O