Foreign currency volatility is an unavoidable reality for businesses operating across borders. As companies expand internationally, fluctuating exchange rates make it harder to maintain accurate financial records and comply with accounting standards.

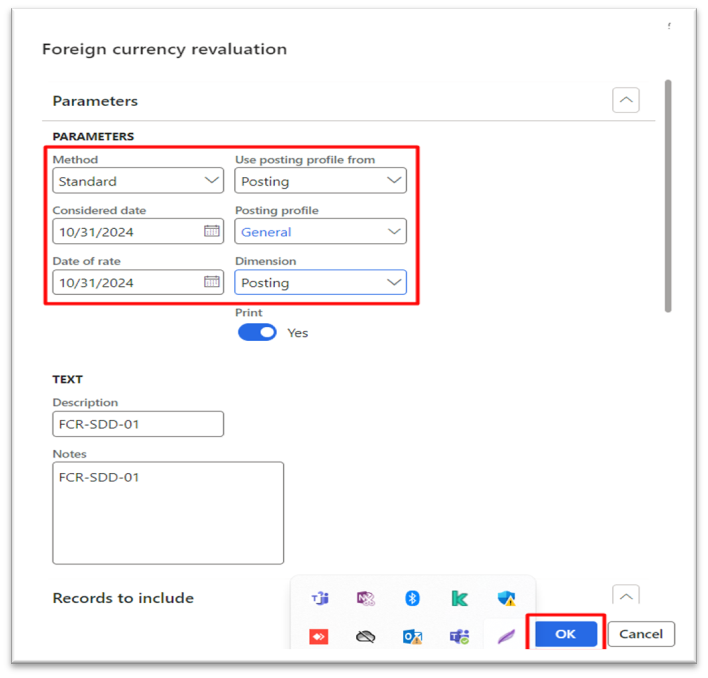

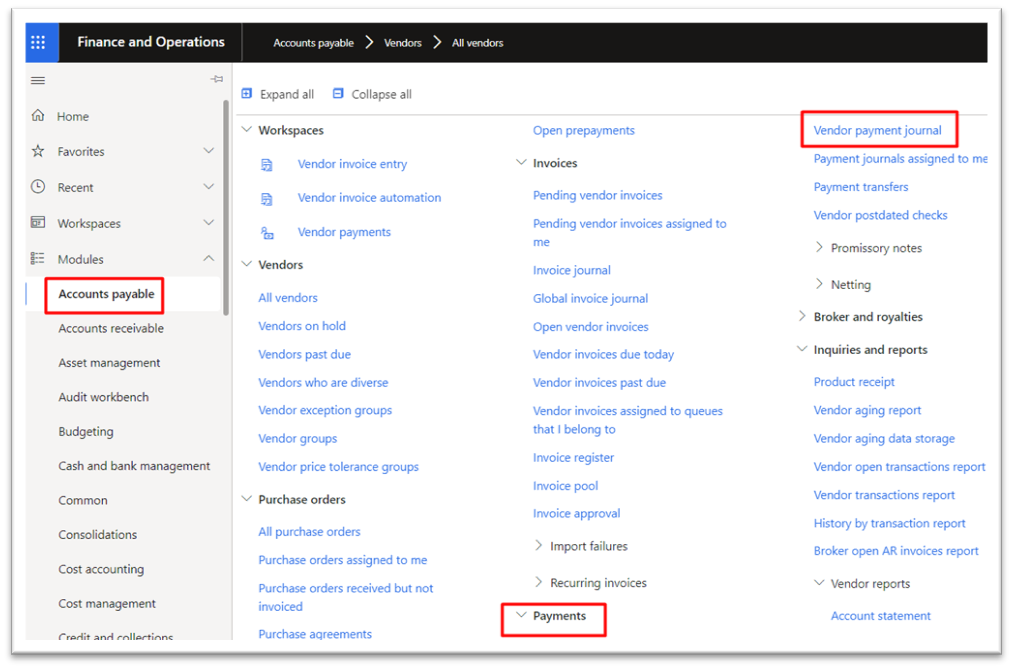

If your finance team still handles foreign currency revaluation manually or through disconnected processes, it’s time to consider a modern approach to streamline this process. The answer lies in leveraging foreign currency revaluation in D365FO, a powerful feature designed to automate revaluations and ensure financial accuracy.

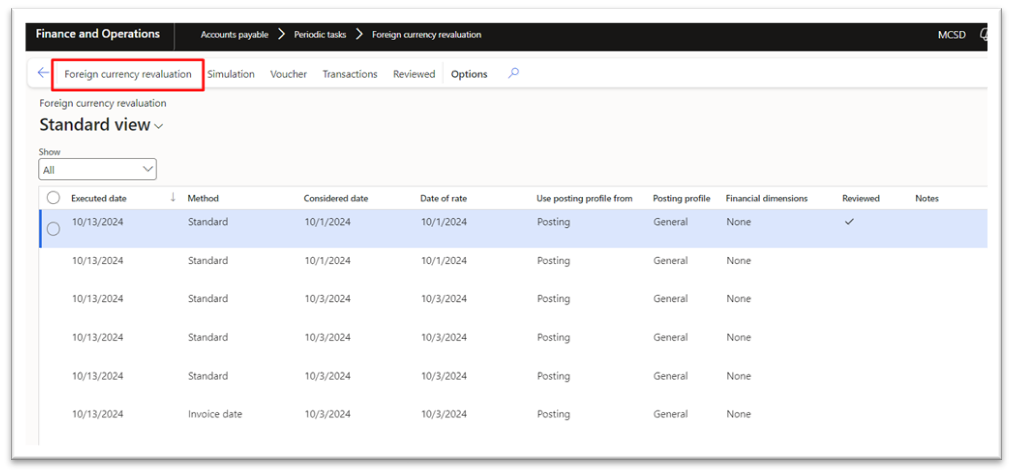

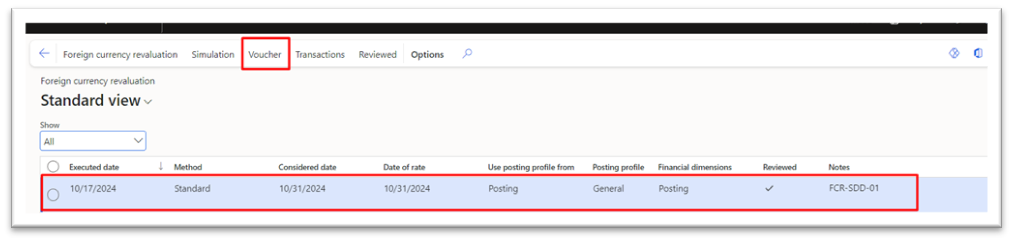

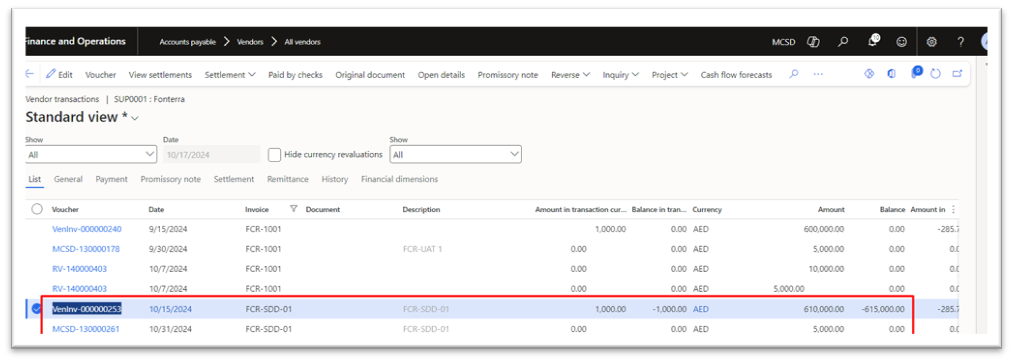

With D365 foreign currency revaluation, finance teams can realign balances, automate foreign currency revaluation accounting entries, and maintain audit-ready transparency.

This is the first blog in a series exploring the foreign currency revaluation process in Dynamics 365 Finance & Operations. In Part 1, we’ll focus on:

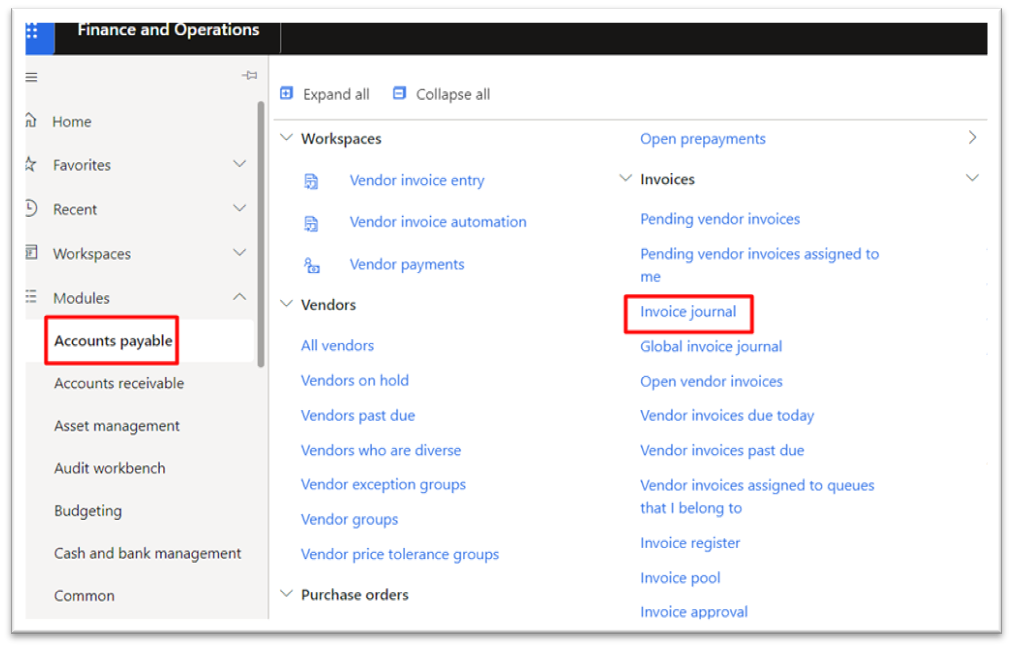

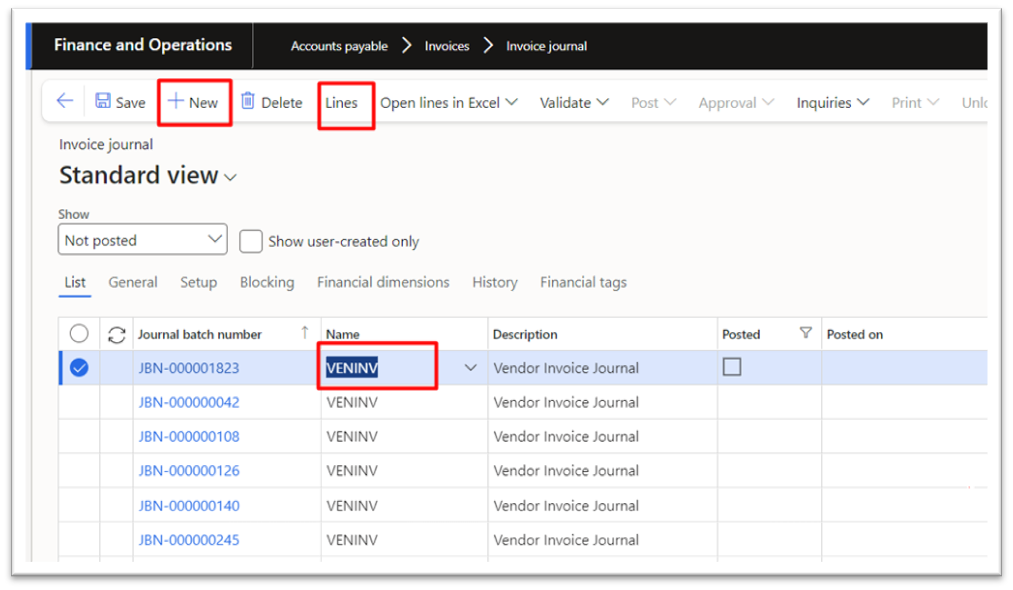

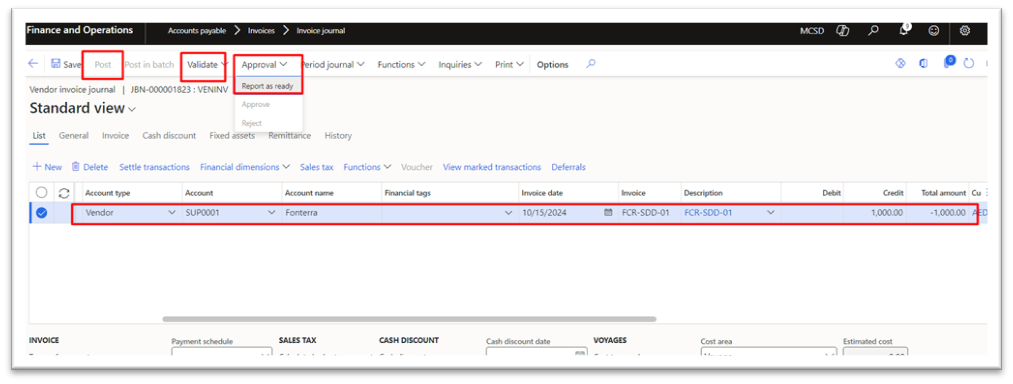

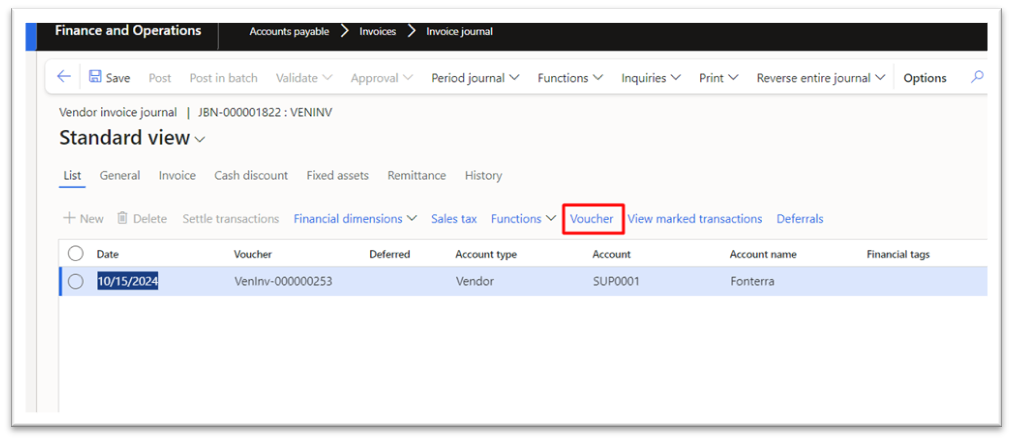

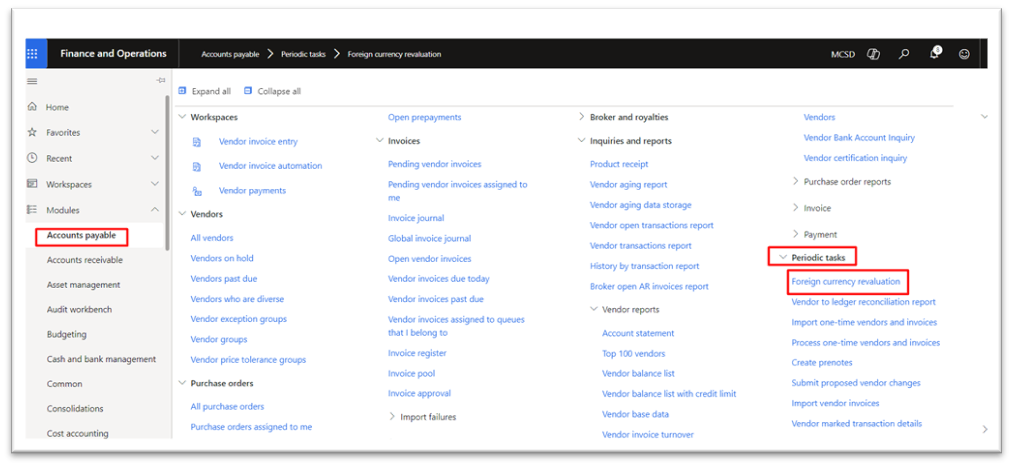

- The Accounts Payable (AP) revaluation process

- When does the revaluation of foreign currency take place?

- How the process supports compliance and operational efficiency

What is foreign currency revaluation?

Foreign currency revaluation is an accounting process that adjusts the value of transactions and balances denominated in foreign currencies to reflect current exchange rates. This ensures that financial statements accurately represent foreign currency assets and liabilities at the end of each reporting period.

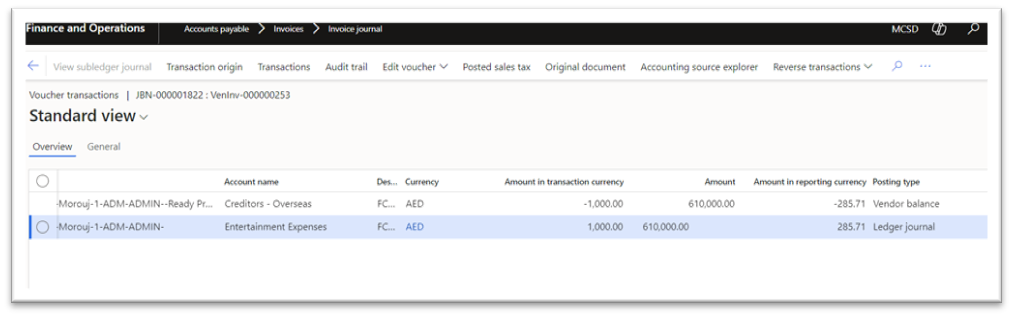

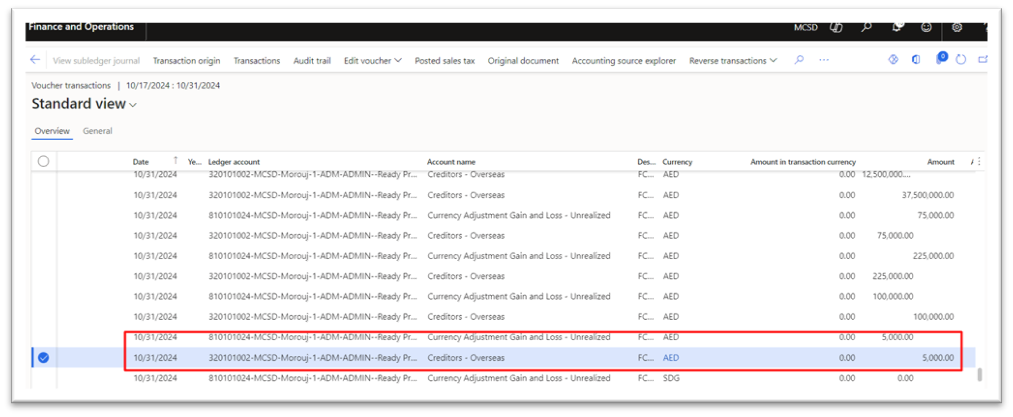

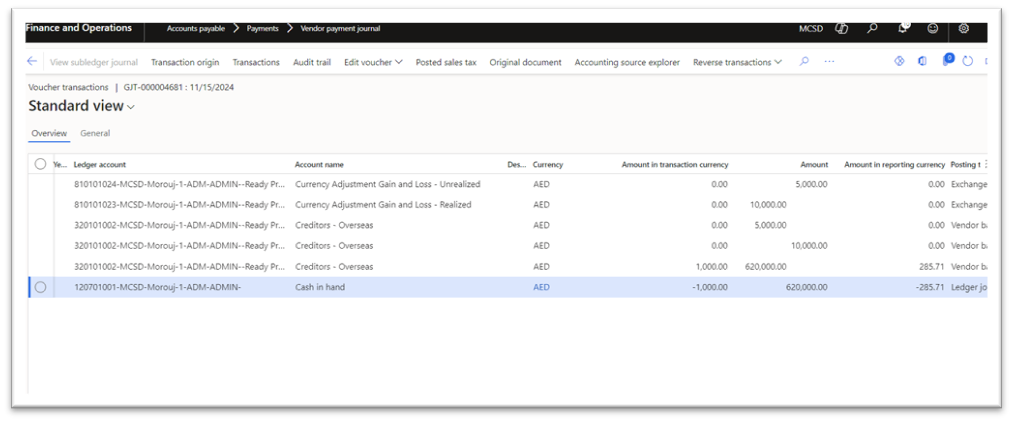

Foreign currency revaluation in D365 can be applied to general ledger accounts, bank accounts, accounts receivable, and accounts payable. The system calculates unrealized gains or losses based on updated exchange rates and posts the necessary foreign currency revaluation accounting entries to designated accounts. This process enables organizations to remain compliant with IFRS and GAAP while maintaining accuracy, consistency, and transparency across their financial records.

Benefits of using foreign currency revaluation in D365 F&O

Implementing foreign currency revaluation in D365FO provides finance teams with powerful tools to improve accuracy, efficiency, and compliance across global operations. By automating the process and reducing manual intervention, businesses can strengthen financial control while minimizing the risks associated with currency fluctuations. Here are some benefits of using this feature:

1. Accurate financial reporting

Realign foreign currency balances using updated exchange rates to ensure financial statements reflect the true values of foreign currency assets and liabilities, maintaining compliance with IFRS and GAAP standards.

2. Minimized currency risk

Identifies unrealized gains and losses proactively, enabling businesses to manage FX exposure before it impacts overall financial performance.

3. Streamlined month-end close

Automates foreign currency revaluation accounting entries and adjustments, significantly reducing manual effort during period-end processes.

4. Audit-ready transparency

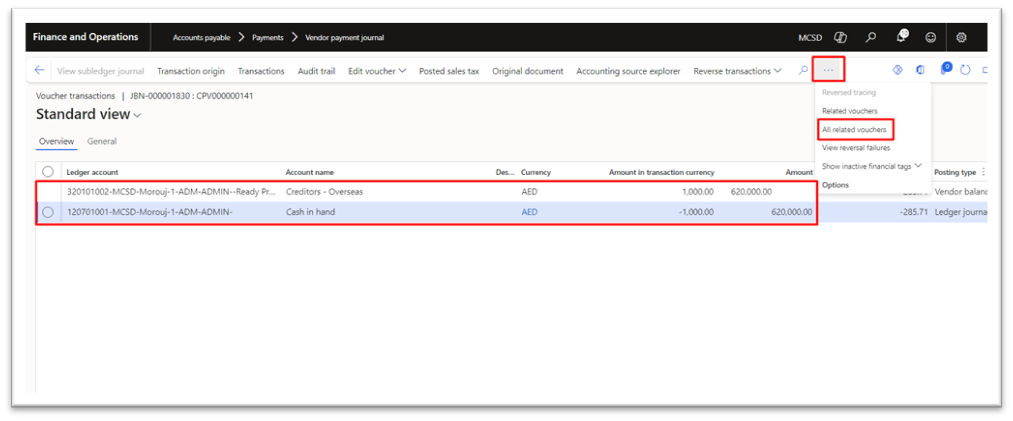

Produces system-generated revaluation journals with complete traceability, supporting stronger audit integrity and internal controls.

5. Scalable for global operations

Supports revaluations across multiple legal entities and currencies, making it ideal for organizations with international operations.